US Service sector activity moderates slightly in August, but remains near decade high

Sep 03, 2015 22:54 pm UTC| Commentary

Following a blockbuster gain in July, the Institute of Supply Management (ISM) non-manufacturing index eased off by 1.3 points to 59.0 in August (from 60.3 in July). Still, the print was ahead of the consensus forecast,...

Will the RBI cut interest rates this month?

Sep 03, 2015 22:17 pm UTC| Commentary

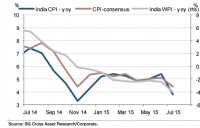

The INR fell 3.5% last month, marking the third worst Asian performance after the MYR (-8.6%) and IDR (-3.8%). Despite lower oil prices (lower trade deficit), portfolio outflows (equities) have accelerated from India. CPI...

BoJ to expand asset purchases this month?

Sep 03, 2015 22:01 pm UTC| Commentary Central Banks

Risk aversion buoyed the cheap JPY (REER) over the past month thanks to Japans current account surplus, but concerns that Chinas slowdown may delay the return of inflation to 2% may prompt the BoJ to expand its QQE...

ECB left policy unchanged but downgraded its growth forecasts

Sep 03, 2015 21:46 pm UTC| Commentary

The ECB left policy unchanged but downgraded its growth forecasts by 0.2ppts and its HICP inflation forecasts by 0.4ppts. Draghi said since developments since 12 August imply downside risks to even these latest new...

ECB will continue its QE purchases beyond September 2016

Sep 03, 2015 21:41 pm UTC| Commentary

ECB president Mario Draghi was very dovish at todays ECB meeting and the ECB is expected to extend QE purchases beyond September 2016. The changed expectation comes mainly as the ECB projects headline inflation will be...

China FX reserves of $3.65trln to support Chinese Yuan

Sep 03, 2015 20:28 pm UTC| Commentary Central Banks

The August Caixin mfg PMI fell to 47.3 the lowest since March 2009, stoking fresh investor fears of a hard economic landing. The 40% drop in the Shanghai composite since June has sparked a global market malaise. The PBoC...

Central bank of Russia on alert to counter market instability

Sep 03, 2015 20:18 pm UTC| Commentary Central Banks

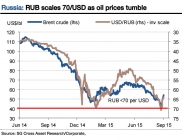

Global risk aversion and the fall in oil prices have pushed the RUB below 70 per USD. The possibility of a rate hike by the CBR is not ruled out and this has prompted to initiate a 1y cross-currency payer trade at 13.05%...

- Market Data