US Q3 GDP tracking 2.6% after July construction spending

Sep 01, 2015 15:27 pm UTC| Commentary

Total construction spending grew 0.7% m/m in July, above forecast (0.4%) and consensus expectations (0.6%), as unexpectedly strong private nonresidential activity boosted total construction outlays. In addition to...

Sep 01, 2015 15:23 pm UTC| Insights & Views Commentary

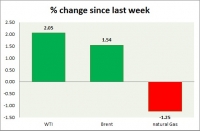

Energy pack is mixed today, while oil is down gas is up. Weekly performance at a glance in chart table. Oil (WTI) WTI is down today after three consecutive days of short covering. Todays range $48.9-45.7 Buy...

Sep 01, 2015 15:23 pm UTC| Commentary Central Banks

Recent developments in China and some of the broader EM regions are likely to feature heavily in the discussions of the ECB Governing Council this week. A significant downward revision in the ECB staff projections for...

UK Manufacturing PMI: Trend of diverging domestic and export led manufacturing output

Sep 01, 2015 14:53 pm UTC| Commentary

The August Manufacturing PMI declined to 51.5, after reporting a print of 51.9 in July. The headline manufacturing index came in lower than consensus expectations, with the underlying details of the report giving mixed...

Tail is wagging the dog as China uncertainty keeps markets on edge

Sep 01, 2015 14:41 pm UTC| Commentary

There are plenty of statistics and market data that show that China barely has an influence on the U.S. economy. For example, the U.S. imports less than 3 percent and exports less than 1 percent of GDP to China and SP 500...

US ISM manufacturing index slides to two-year low in August

Sep 01, 2015 14:35 pm UTC| Commentary

The US ISM manufacturing index fell to 51.5 in August, posting a larger decline on the month than both we (52.0) and the consensus (52.5) had expected. The decline was led by the components of the survey that tend to be...

Central banks in action of regulating currencies, why not Fed?

Sep 01, 2015 13:22 pm UTC| Commentary Central Banks

We have been arguing that normalization of monetary policies will be driving markets for years to come. We expect the Fed to lead the way. Other G10 central banks are likely to continue moving to the opposite direction for...

- Market Data