Daily Economic Outlook: 20th August, 2015

Aug 20, 2015 04:07 am UTC| Commentary

US data this afternoon include July existing home sales and the Conference Boards leading index. But the highlight will be the Philadelphia Feds business outlook survey for August. The Empire manufacturing survey for...

Policy makers broadly accept China Yuan Reminbi devaluation

Aug 20, 2015 04:00 am UTC| Commentary

Regarding the market impact on different Reminbi asset classes, generally all should retrace toward the levels before the change, however, they will not fully return totheir previous levels. The implied volatilities, risk...

Chinese Yuan weakening adds to regional depreciation pressure

Aug 20, 2015 03:48 am UTC| Commentary

China shocked the world by changing the CNY fixing mechanism unexpectedly, and the entire market tumbled, especially EMs. CNY/CNH itselfrecorded the steepest drop in both fixing and spot since 1994. The key improvement...

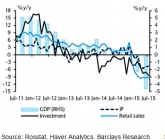

Russia's economic growth indicators signal extended recession

Aug 20, 2015 03:43 am UTC| Commentary Economy

Russia growth indicators for July deteriorated further. In particular, real wages declined 9.2% y/y from an unrevised -7.2% and revised -8.6% in June and investment fell 8.5% y/y from -7.1% in June. Retail sales,...

Conditions for Fed liftoff “approaching”

Aug 20, 2015 03:38 am UTC| Commentary

At the July meeting, many Fed participants felt confident that hike would be supported by sustained growth and further improvements in the labor market. However, some participants said that the incoming information had...

September FOMC hike still expected, but risks are higher

Aug 20, 2015 03:35 am UTC| Commentary Central Banks

Data is consistent with the beginning of policy normalization in September. Data on US activity received since the July meeting have been quite positive on balance and should push the FOMC toward near-term lift-off. This...

Minutes of Fed's July 28-29 Meeting

Aug 19, 2015 19:03 pm UTC| Commentary Central Banks

The minutes provided no clues about the Feds preparedness to raise rates as early as the September meeting. Anticipating a clearer signal but getting none, Treasuries rallied and the dollar fell. While September remains on...

- Market Data