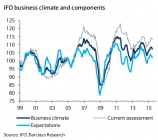

Germany’s domestic demand remains the key growth driver

Jul 22, 2015 22:24 pm UTC| Commentary

Germanys final domestic demand grew strongly again in Q1 (0.8% q/q) reflecting robust consumer and investment activity. The latest surge in consumer spending is largely a result of the sharp fall in oil prices through...

Euro area inflation outlook under the microscope

Jul 22, 2015 22:05 pm UTC| Commentary Economy

Headline HICP inflation fell from +3.0% at the end of 2011 to -0.6% in January 2015, before rebounding to +0.2% in June. Despite showing signs of improvement lately, core prices remained very weak, edging down to 0.8% from...

ECB monetary policy on hold with an easing bias

Jul 22, 2015 21:48 pm UTC| Commentary

Barclays notes:Since the ECB launched its asset purchase programme in March, the Governing Council has remained cautiously optimistic about its potential effect. Although President Draghi highlighted a slight loss of...

Greek Parliament to vote on a second batch of reforms today

Jul 22, 2015 20:54 pm UTC| Commentary

There is another vote in the Greek Parliament today (just after midnight local time; 5am HKT). The bill covers civil procedures and the bank resolution directive. PM Tsipras has been publically voicing criticism of Syriza...

RBNZ to deliver another 25bps cut at this morning’s OCR review

Jul 22, 2015 20:33 pm UTC| Commentary

RBC Capital Markets notes:We expect the RBNZ to deliver another 25bps cut at this mornings OCR review. Indeed, given the weak rate of underlying inflation and steep falls in dairy prices, we recently shifted our profile to...

The PBOC Moving at a Rapid Pace

Jul 22, 2015 17:52 pm UTC| Commentary

The Peoples Bank of China is firing on all cylinders intervening in the economy in an attempt to stabilize economic growth and structural adjustment. The PBOC will add $45 billion to the Export and Import Bank of China in...

Euro area inflation set to remain well below 2% until at least end-2016

Jul 22, 2015 17:18 pm UTC| Commentary

Despite the recent increase in headline and core inflation, it is premature to dispel deflation fears, and our vulnerability indicator suggests that euro area-wide deflation risks remain substantial. After having dropped...

- Market Data