FxWirePro: Key charts explaining crude oil inventories and production report of EIA

Jan 11, 2019 08:53 am UTC| Commentary

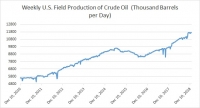

Here are some key charts based on data from the United States Energy Information Agencys (EIA) latest report that explains the level of inventories, refinery demand, and production. Chart 1 shows crude oil production...

Jan 11, 2019 07:23 am UTC| Commentary

Platts has released its November oil market production survey and it suggests that OPEC production is set to decline big in December compared to November, including Nigeria and Libya, and new member Congo. The gap is...

FxWirePro: The Day Ahead- 11th January 2019

Jan 11, 2019 07:07 am UTC| Commentary Central Banks

Lots of economic data and events scheduled for today, and some with high volatility risks associated. Data released so far: Australia: Retail sales up 0.4 percent in November. Japan: Eco-watchers survey...

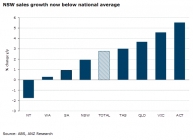

Australia retail sales slightly beat expectations in November, rising 0.4 pct m/m

Jan 11, 2019 06:30 am UTC| Commentary Economy

Australias retail sales beat expectations slightly in November, rising 0.4 percent m/m. Clothing and household goods sales improved, likely reflecting the growing popularity of Black Friday sales in November, which in the...

Australian bonds trade flat despite better-than-expected November retail sales

Jan 11, 2019 04:23 am UTC| Commentary Economy

Australian government bonds traded flat during Asian session Friday as investors remain sidelined in quiet trading session despite better-than-expected November retail sales data. Retail sales beat expectations slightly...

U.S. headline inflation likely to have eased in December on marked fall in energy prices

Jan 10, 2019 19:35 pm UTC| Commentary

The U.S. headline inflation data for the month of December is set to release tomorrow. According to a TD Economics research report, the oil prices are expected to have retreated sharply to be reflected on a significant 8.4...

Jan 10, 2019 18:31 pm UTC| Commentary

Swedish headline inflation is likely to come in line with the Riksbanks forecast in December; however, downside risks dominate. Our call for December CPIF at 2.2 percent y/y and CPIF ex energy at 1.5 percent y/y is in...

- Market Data