It is not too hard to draw parallels between the size of the BoJ and the SNB’s balance sheets, and hence the potential constraints on the SNB’s FX policy which amounts to a soft floor in EURCHF.

It's noteworthy that this informal floor has required the SNB to intervene on almost a continuous weekly basis since the SNB resumed intervention last spring.

In simple terms, the SNB has to recycle virtually all of Switzerland’s current account surplus (12% of GDP) as private capital outflows are essentially zero. An FX policy that's credible requires little intervention; one that lacks this fundamental credibility requires the brute force of intervention.

In a sense, the SNB is in a worse position now than when it was formally capping the franc since the formal cap was credible for long periods of its life and the SNB had no need to intervene. We’re not necessarily arguing that the SNB is about to cease intervention, more that the risks of this occurring increase the more intervention the central bank is forced to conduct.

Formal or informal, a currency cap creates asymmetric upside potential for a currency that’s worth positioning for.

OTC Updates and Option Strategy:

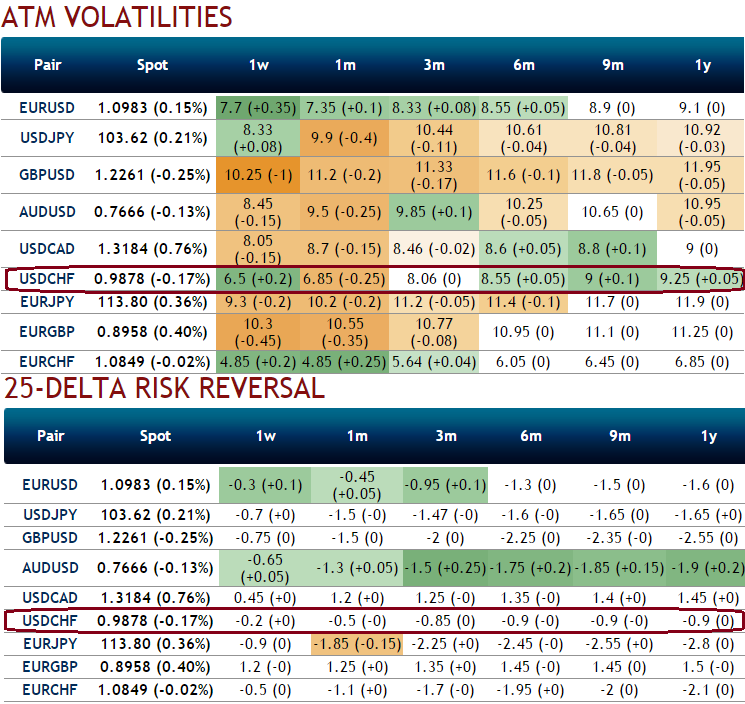

ATM implied volatilities are severely shrinking away, slipped below 7% (to be precise 6.5% for 1W expiries and 6.85% for 1M expiries). Well, if you have short positions in option and IVs are shrinking away, bingo..!! It's a conducive environment for option writers.

While, risk reversals have also been in sync with IVs and spot FX movements as stated above in technical lines, these numbers also have been bearish-neutral for next 1 month or so. 25-delta risk reversal evidences the disparity in volatility, and price, between puts and calls on the most liquid out of the money (OTM) options quoted on the OTC market.

Hence, we recommend long put ladder or bear put ladder strategy, that is the limited returns and unlimited risk strategy in options trading that is employed as we reckon that the IVs are the least and the underlying spot FX would experience little volatility in the near term.

To setup this strategy, the options trader initiates long in an in-the-money put, sells an at-the-money put and sells another lower strike out-of-the-money put of the same underlying security and expiration date.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data