FxWirePro: NZD/JPY weakness on cards, any bounces..? Capitalize on shorts in put ladders

Nov 06, 2015 05:47 am UTC| Insights & Views Technicals

We continue to maintain bearish stance in long run, while if any abrupt short term upswings could also to be monitored and utilized by below strategy. In our opinion, although some price recoveries that weve been seeing...

Nov 06, 2015 05:21 am UTC| Insights & Views Technicals

Well..! Its not a miracle but sheer research and mere effects of bearish pattern that we spotted out in our earlier post. So, before proceeding further please refer below link as to understand on how the hanging man...

Nov 05, 2015 18:17 pm UTC| Insights & Views

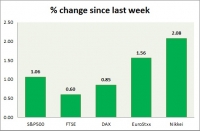

Equities are all mixed performer in todays trading. Kindly note all instruments mentioned here are CFDs, whose values might differ from cash or future traded. Performance this week at a glance in chart table - SP 500...

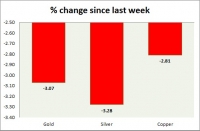

Commodities snapshot (precious & industrial)

Nov 05, 2015 18:04 pm UTC| Insights & Views

Metal pack is trading in red. Performance this week at a glance in chart table - Gold - Gold is down for seventh consecutive day, and third consecutive week. Gold after breaking support around $1120 has broken below...

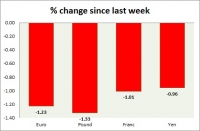

Currency snapshot (major pairs)

Nov 05, 2015 17:47 pm UTC| Insights & Views

Dollar index trading at 98.02 (+0.14%). Strength meter (today so far) - Euro +0.00%, Franc -0.34%, Yen -0.20%, GBP -1.10% Strength meter (since last week) - Euro -1.23%, Franc -1.01%, Yen -0.96%, GBP -1.33% EUR/USD...

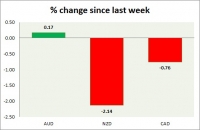

Currency snapshot (commodity pairs)

Nov 05, 2015 16:18 pm UTC| Insights & Views

Dollar index trading at 98.02 (+0.13%) Strength meter (today so far) - Aussie +0.07%, Kiwi +0.45%, Loonie -0.16%. Strength meter (since last week) - Aussie +0.17%, Kiwi -2.14%, Loonie -0.76%. AUD/USD - Trading at...

Commodities snapshot (energy) - corrected

Nov 05, 2015 15:54 pm UTC| Insights & Views

Energy pack is mixed, while gas is up oil is down. Weekly performance at a glance in chart table. Oil (WTI) - WTI reversing gains since yesterday, however bulls and bears are broadly balanced. Todays range...

- Market Data