Russian economic downturn and oil slump keep up pressure on Rouble

Aug 03, 2015 13:31 pm UTC| Insights & Views

Latest PMI report revealed that economic downturn is not done with. PMI index, which is a gauge for manufacturing slipped to 48.3 in July from 48.7 in June. A number below 50 indicates contraction and vice versa. Russian...

FxWirePro: EUR/CAD collars to hedge uptrend continuation

Aug 03, 2015 12:51 pm UTC| Insights & Views

The leading oscillators are showing healthy convergence with every price spikes. RSI (14) looks healthily converging at 61.9093 with every price rises, it has neither approached oversold zone nor even overbought territory...

Aug 03, 2015 12:34 pm UTC| Insights & Views

CFTC commitment of traders report was released on Friday (31st July) and cover positions up to Tuesday (28th July). COT report is not a complete presenter of entire market positions, since future market is relatively...

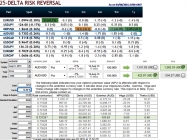

FxWirePro: AUD/USD delta risk-reversal signifies overpriced puts; HY gamma spreads for IV riddle

Aug 03, 2015 12:30 pm UTC| Insights & Views

Rationale: Prevailing implied volatility rates for AUD/USD ATM 1M-6M contracts are in range of 12% to 14%. But higher negative delta risk reversal indicates put contracts have been relatively costlier. In the nutshell,...

Difficult to keep good Koruna down

Aug 03, 2015 12:21 pm UTC| Insights & Views

The Czech National Banks (CNB) peg with Euro is clearly under threat as it is and going to be difficult to keep the good Czech Koruna down. Latest manufacturing PMI report showed, while many economies in Euro zone are not...

US personal consumption expenditure (June) preview

Aug 03, 2015 12:01 pm UTC| Insights & Views

Personal consumption, income data along with PCE price index would be released from US at 12:30 GMT. Why it matters? Personal consumption and income data provide information on consumer sentiment. Consumers tend to...

Aug 03, 2015 11:37 am UTC| Insights & Views

Technical Inference:Bears in bullion market are testing channel line support at 1071 levels on weekly basis but prices are most likely to remain in range (1070-1105 levels), if it manages to hold then the marginal bounces...

- Market Data