Asian currency basket sluggish mostly on trade deficit

Jun 01, 2015 08:02 am UTC| Insights & Views

Chinese Executive PMI numbers: The flash appraisal of the HSBC manufacturing PMI MoM improved reasonably from its lowest level of 48.9 in April to 49.1 in May. The domestic demand was improved while production and export...

India shines bright among emerging economies

Jun 01, 2015 08:01 am UTC| Insights & Views

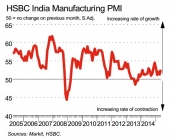

After soft economic data, pointed at turning sentiment among consumers and businesses, today hard data showed Indias manufacturing sector is reversing its downtrend. Reforms pursued by New Bharatiya Janata Party (BJP) led...

Construct Strips on EUR/USD on bearish engulfing pattern

Jun 01, 2015 07:25 am UTC| Insights & Views

Since the heat news are boiling on the verge of Greece debt repayment to IMF it is sensed that all chances of dollar may look superior over Euro in medium term, thus we advise to hedge the Euros depreciation over USD...

Greece mounting strains in Euro area

Jun 01, 2015 07:19 am UTC| Insights & Views

Greece is set to meet its 300m obligation to the IMF on 5 June and Greek negotiators are optimistic about a potential deal, the risk is that creditors become impatient and propose a "take-it-or-leave-it" deal in the coming...

Guide to today’s important data and events

Jun 01, 2015 07:09 am UTC| Insights & Views

Lot of economic dockets to be released today, with high risk associated. Focus is on manufacturing PMI across globe and US PCE. Data released so far - Australia - Building permits dropped by -4.4% m/m in April, still...

Spot EUR/AUD positions look attractive to hedge put options

Jun 01, 2015 06:37 am UTC| Insights & Views

Lets visualize a trader thought implied volatility expanding in the near month contract of EUR/AUD put option which is overpriced; therefore he tends to short the volatility.Suppose, the delta on ATM put options is at...

Spot EUR/AUD positions look attractive to hedge put options

Jun 01, 2015 06:37 am UTC| Insights & Views

Lets visualize a trader thought implied volatility expanding in the near month contract of EUR/AUD put option which is overpriced; therefore he tends to short the volatility.Suppose, the delta on ATM put options is at...

- Market Data