Dec 13, 2017 10:41 am UTC| Central Banks Research & Analysis Insights & Views

We expect the Fed to hike rates by 25bps today, bringing the funds rate to 1.375%. More interesting will be the Feds dot plot, particularly the median rate outlook in 2018. In short, the dots could have a marginally dovish...

Announcement: Moody's: Outlook for Japanese financial institutions is stable in 2018

Dec 13, 2017 08:17 am UTC| Research & Analysis

Tokyo, December 13, 2017 -- Moodys Japan K.K. says the outlook for Japans financial institutions, including banks, insurance companies and finance companies, is stable in 2018, reflecting the improved operating...

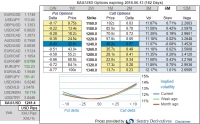

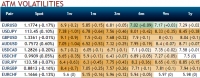

FxWirePro: Short 1y USD/JPY skews via put spreads ahead of Fed and BoJ

Dec 13, 2017 07:24 am UTC| Central Banks Research & Analysis Insights & Views

The key attention today will be on the Fed but if you look through the What to watch today, the answer is rate hike of 25 bpstonight is fine, but how much in 2018? The Fed will almost certainly hike rates by...

Dec 13, 2017 07:04 am UTC| Central Banks Research & Analysis Insights & Views

Fed is scheduled to announce funds rates decision tomorrow, and weve already stated in our previous post that the Federal Reserve is no longer expected to pause the rate hike cycle early next year for two main reasons....

Dec 12, 2017 14:48 pm UTC| Digital Currency Research & Analysis Insights & Views

The journey from $751.34 to a whopping $17,270 (at BITSTAMP exchange), or 2,199% in this year so far with a fortnight trading spare: Bitcoin price analysis BTCUSD surged to almost a mammoth 195% in this...

Dec 12, 2017 13:17 pm UTC| Research & Analysis Technicals Central Banks

Chart and candlestick pattern formed: 50% Fibonacci retracements from the peaks of $1357.47 (refer weekly plotting). The decisive breach below strong support at $1261.12, thats where a stern bearish candle pops up with...

FxWirePro: Figure odds out and hedge in Asian FX bloc and equities via options strategy in 2018

Dec 12, 2017 12:24 pm UTC| Research & Analysis Insights & Views

We are particularly concerned with how market sentiment may respond to Chinas growth slowdown, topping-out of EM growth indicators, heavy real money positioning, and the widening in credit spreads in 2H. Elsewhere, in...

- Market Data