Nov 24, 2017 06:55 am UTC| Research & Analysis Insights & Views

AUDNZD major downtrend has been drifting in the consolidation phase and jerky in short run, drop to 1.0989 levels (recent lows). For now, continues to consolidate between 1.1000 and 1.1100. AUDNZD in medium-term...

FxWirePro: Fair interpretations and intricacies of hedging drivers of EMEA EMFX

Nov 23, 2017 18:05 pm UTC| Research & Analysis Insights & Views

EMEA EM FX: We remain MW overall, and add a short ZAR outright trade. We encourage MW in the JPMs GBI-EM Model Portfolio with an OW in RUB hedged against UW in ZAR and OW in PLN and CZK hedged against UW in RON. While...

Nov 23, 2017 13:27 pm UTC| Research & Analysis Insights & Views

Given that palladium is widely regarded as the most industrial metal within the precious metals complex and more closely linked to the business cycle, it is not surprising that its price rose at the strongest pace, gaining...

Nov 23, 2017 12:21 pm UTC| Research & Analysis Insights & Views

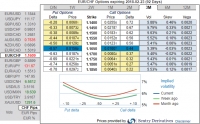

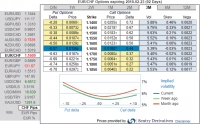

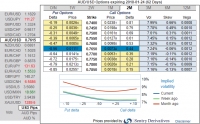

Long EURCHF has been encouraged on account of the underperformance of Swiss franc this week is a response the upward pressure on global bond yields; it is not a beta move to EURUSD as such. We continue to doubt quite...

Nov 23, 2017 12:21 pm UTC| Research & Analysis Insights & Views

Long EURCHF has been encouraged on account of the underperformance of Swiss franc this week is a response the upward pressure on global bond yields; it is not a beta move to EURUSD as such. We continue to doubt quite...

Nov 23, 2017 07:31 am UTC| Research & Analysis Insights & Views

Crude prices were stronger after another large drawdown in inventories buoyed investor sentiment. The EIA weekly report showed that US stockpiles fell by 1.86 million barrels last week. This was a little lower than...

Nov 23, 2017 07:02 am UTC| Research & Analysis Insights & Views

Markets will closely watch the PMIs for November. Ongoing strength in global growth remains crucial to sustaining risk appetite and keeping volatility low. In the near-term, global sentiment will continue to remain a key...

- Market Data