FxWirePro:Nikkei2225 hits fresh year high on OPEC deal, good to buy on dips

Dec 01, 2016 03:24 am UTC| Technicals

Nikkei225 hits year high and is trading well above 18482 recent high made on account of OPEC production cut deal. It is currently trading at 18727 0.63% higher. OPEC reached a deal yesterday for a production cut by 1.2...

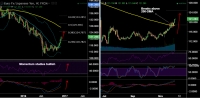

FxWirePro: EUR/JPY short-term outlook

Dec 01, 2016 02:45 am UTC| Technicals

Bullish momentum builds in EUR/JPY, we see scope for upside to test 125 levels in the coming weeks. The pair has broken consolidation phase with rising volumes as evidenced on daily charts. Technical indicators...

FxWirePro: Chinese yuan depreciates despite higher than expected manufacturing PMI data

Dec 01, 2016 02:42 am UTC| Technicals

USD/CNY is currently trading around 6.8952 marks. It made intraday high at 6.8952 and low at 6.8837 levels. Intraday bias remains slightly bullish till the time pair holds immediate support at 6.8807...

Dec 01, 2016 02:11 am UTC| Technicals

EUR/KRW is currently trading around 1,244 mark. Pair made intraday high at 1,246 and low at 1,244 levels. Intraday bias remains bearish till the time pair holds key resistance at 1,251 mark. A sustained...

FxWirePro: AUD/NZD holds major trendline support at 1.04, good to short break below

Dec 01, 2016 01:46 am UTC| Technicals

AUD/NZD is extending the Bullish Butterfly pattern on daily charts. The pair has taken major trendline at 1.0415. Violation at trendline could see test of 1.0363 (Nov 9 lows). Our previous call...

FxWirePro: USD/SGD jumps above 1.43 mark, faces strong resistance at 1.4365 mark

Dec 01, 2016 01:34 am UTC| Technicals

USD/SGD is currently trading around 1.4324 marks. It made intraday high at 1.4352 and low at 1.4322 levels. Intraday bias remains neutral till the time pair holds key resistance at 1.4365 marks. A sustained...

FxWirePro: USD/JPY hits fresh 10-month high at 114.82 in early hours of Asia, bias remains bullish

Dec 01, 2016 01:11 am UTC| Technicals

USD/JPY is currently trading around 114.42 marks. It made intraday high at 114.82 and low at 114.27 levels. Intraday bias remains bullish till the time pair holds key support at 112.05 levels. A daily close...

- Market Data