Mar 24, 2025 10:43 am UTC| Technicals

The pair has been consolidating between 0.83500 and 0.83904 for the past three days. Intraday bias remains bearish as long as resistance 0.8450 holds. It hit an intraday low of 0.83689 and is currently trading around...

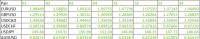

FxWirePro- Major European Indices

Mar 24, 2025 10:15 am UTC| Technicals

Major European Indices Germany DAX - 22958 (0.33%) Major resistance- 23820/24000 Near-term resistance -23050/23300/23500/23800 Minor support - 22800/22645/22490/22200/21735/21500. Trend...

Mar 24, 2025 10:02 am UTC| Technicals

The EUR/JPYgained slightly after upbeat German PMI data. It hit an intraday high of 162.56 and is currently trading around 162.19.The intraday outlook is bullish as long as the support of 160.70 holds. In March 2025,...

FxWirePro: GBP/USD positions for another climb, eyes 1.3000 level

Mar 24, 2025 10:00 am UTC| Technicals

GBP/USD climbed above 1.2950 level on Monday as dollar weakened as traders cautiously awaited clarity on U.S. President Donald Trumps next round of tariffs.. UK Finance Minister Rachel Reeves will present a half-yearly...

FxWirePro: USD/ZAR struggles for direction as investors await clarity on U.S. tariffs

Mar 24, 2025 09:08 am UTC| Technicals

USD/ZAR initially gained on Monday but gave up ground investors awaited clarity on the next round of tariffs from U.S. President Donald Trump. The next wave of U.S. tariffs is scheduled for April 2, when the White...

FxWirePro: USD/CNY hits two-week high as yuan weakens on trade concerns

Mar 24, 2025 08:31 am UTC| Technicals

USD/CNY hit two week high on Monday as investor concerns grew over U.S.-China trade disputes, with Trumps reciprocal tariffs deadline approaching. Investors remain focused on U.S. trade policies, with the White House...

- Market Data