Oil in Global Economy Series: Angola SOS IMF

Apr 07, 2016 07:01 am UTC| Commentary

Angola sent a distressed signal to International Monetary Fund (IMF), worth $1.5 billion, making its first OPEC member to fall victim of oil price rout. After pushing many high cost producers to bankruptcies in U.S. shale...

Can WTI end its biggest consecutive daily decline since 2009?

Apr 05, 2016 12:15 pm UTC| Commentary

North American benchmark, West Texas Intermediate (WTI) is up today and trying to end its biggest consecutive daily decline since 2009. Yesterday, it was up in Asian and early European hours, but later turned negative...

Oil in Global Economy Series: Saudi Arabia bleeds reserve amid lower oil

Apr 05, 2016 07:19 am UTC| Commentary

Saudi Arabias pains are visibly on the rise as the economy facing threats of downgrades, if it fails to check on its ballooning fiscal deficit, which is projected to be 15-16% of GDP this year. In a separate article, we...

Oil In Global Economy Series: Report card on Saudi market share strategy

Mar 31, 2016 12:06 pm UTC| Commentary

Yesterday under this series, we inferred that Saudi Arabias strategy to over produce in an already over-supplied market, push the prices lower, push out high cost producers from the market like shale oil and increase...

Price shock: how the gas industry is weathering the oil crash

Mar 30, 2016 13:31 pm UTC| Insights & Views

Falling oil prices are causing a shake-up in the gas industry. The latest sign of this is Australian energy company Woodsides indefinite deferral of its huge gas project off northwest Western Australia. The A$40 billion...

Oil in global economy series: Saudi games not working

Mar 29, 2016 11:05 am UTC| Commentary

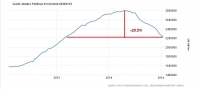

After more than a year into deployment, cracks are now plenty to conclude that Saudi Arabias strategy to keep production high, drive out high cost producers and increase/retain its market share has failed. Instead its...

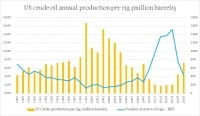

Oil in Global Economy Series: Why rigs deactivation doesn't matter much?

Mar 28, 2016 10:23 am UTC| Commentary

According to latest numbers from Baker Hughes, number of active oil rigs operating in United States has dropped to lowest levels since 2008/09 financial crisis. While back in October, 2014, the number of active rigs were...

- Market Data