WTI is sharply down after clearing key support area around $43/barrel. WTI is currently trading at $42.3/barrel, up from today's low around $41.6/barrel ahead of EIA report, scheduled for 16:00 GMT.

Key factors at play in Crude market

- According to latest report, except for Permian region, in all other areas crude oil production is declining fast in US. However increased efficiency has prevented any large compared to sharper drop in rig count.

- Due to new and improved technologies, crude oil production cost has declined for shale producers.

- OPEC report showed, crude production dropped to 10.1 million barrels/day in Saudi Arabia but overall OPEC production is still high at 31.4 million barrels/day.

- Any cooperation is unlikely with Russia and Saudi Arabia fighting for market share in Europe.

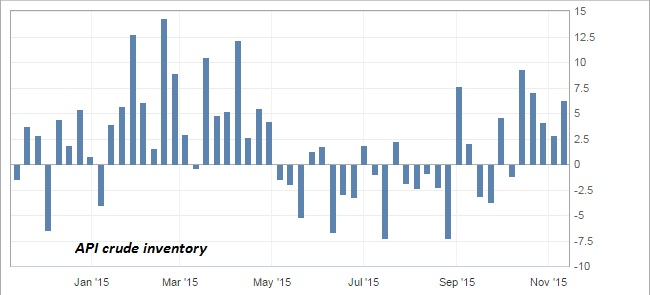

- American Petroleum Institute's (API) weekly report showed inventory surplus by 6.3 million barrels.

- Oil price is down, however lack of investments in the sector make prices vulnerable to supply shocks in future.

Today's inventory report from US Energy Information Administration (EIA), to be released at 16:00 GMT.

Trade idea

- Increased rate hike expectation and strong Dollar from FED has tilted the balance of bulls & bears, in favor of the latter.

- WTI is now closing in onto lowest level since 2009, likely to drop towards $37-38/barrel area.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary