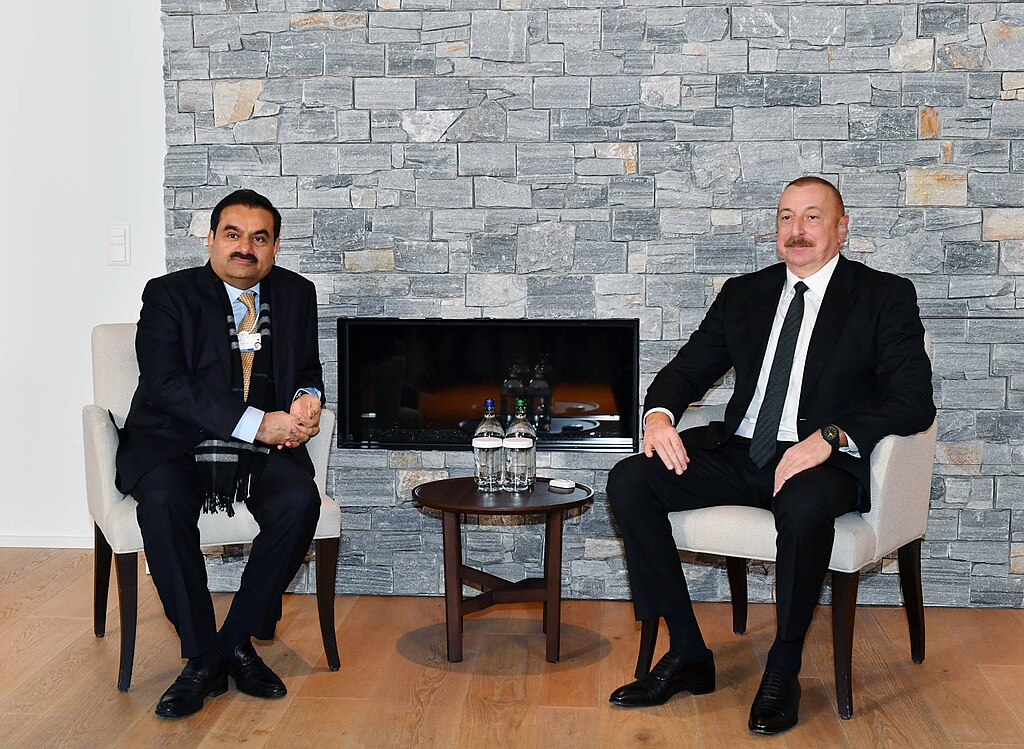

Shares of Adani Group companies declined on Tuesday after a Wall Street Journal (WSJ) report revealed a U.S. investigation into potential violations of Iran sanctions. U.S. prosecutors are reportedly examining whether tankers linked to the conglomerate transported Iranian liquefied petroleum gas (LPG) to India’s Mundra port, operated by Adani, possibly breaching international sanctions.

According to WSJ, the U.S. Attorney’s Office in Brooklyn is investigating vessels connected to Adani Enterprises that may have obscured their movements using methods like tampering with the ship’s automatic identification system (AIS). Maritime analysts say these tactics are commonly linked to sanctions evasion, particularly in the Persian Gulf region.

Adani strongly denied the allegations, stating it has not engaged in any sanctioned trade activity. “Adani categorically denies any deliberate engagement in sanctions evasion or trade involving Iranian-origin LPG,” a spokesperson said. The group also stated it is unaware of any ongoing U.S. probe.

Despite the denial, Adani Enterprises shares dipped 1.1%, while Adani Ports lost 1.4%. Adani Total Gas, Adani Power, Adani Green Energy, and Adani Energy Solutions fell between 0.6% and 1.6%.

The news arrives at a sensitive moment for the group, which has been rebuilding investor trust after facing scrutiny from a short-seller report last year. The investigation coincides with former U.S. President Donald Trump’s renewed focus on strict enforcement of sanctions against Iran. In May, Trump warned that any entity purchasing Iranian oil or petrochemicals would face secondary sanctions and be barred from doing business with the U.S.

Year-to-date, Adani Ports has gained 16%, while Adani Total Gas is down 11%, reflecting divergent investor sentiment across the group’s portfolio.

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns