Former Labor leader and governor-general Bill Hayden, whose death was announced on Saturday, is rightly being remembered for introducing Australia’s first universal healthcare scheme Medibank, which lives on today as Medicare.

Less well known is his brief but important role as Australia’s treasurer in 1975. It was five months in which he set Labor, and ultimately Australia, on the path to what became known as economic rationalism.

‘Why is he so interested in economics?’

Unexpectedly winning the Queensland seat of Oxley for Labor from the Menzies Coalition government at the young age of 28 in 1961, the former policeman thought about studying law at the University of Queensland but chose economics instead because he believed it was more likely to transform society.

His 1968 booklet, The Implications of Democratic Socialism, was ahead of its time in advocating both a national health scheme “with free hospitalisation” and a national superannuation scheme. It sold 5,000 copies.

But his interest in economics was not always appreciated within his own party.

Labor leader from 1960 to 1967 Arthur Calwell once asked

why does young Hayden keep raising the problem of the balance of payments? Why doesn’t he just be like a normal politician and worry about his electorate?

Understudy, then Treasurer

Calwell’s replacement, Gough Whitlam, considered appointing Hayden treasurer when he won the 1972 election. Instead he appointed Frank Crean in recognition of Crean’s long service as shadow treasurer, and added Hayden to Cabinet’s economic committee, where he was referred to as “Crean’s understudy”.

Hayden served as acting treasurer nine times. In this role he became an irritant to Whitlam, warning of the risks of expanding government spending too quickly and arguing for tax increases in contravention of Whitlam’s policy speech.

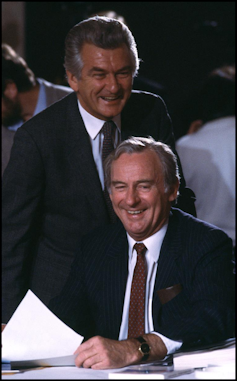

Hayden investigated floating the dollar a decade before the Hawke government did it. National Archives, CC BY-SA

Hayden also investigated floating the dollar (a decade before the Hawke government did it) but found the treasury and the Reserve Bank unenthusiastic.

In June 1975, with Medibank bedded down, Whitlam finally made Hayden treasurer.

Hayden set about repairing relations with the treasury which had become very strained under Crean’s first replacement Jim Cairns.

Perhaps more than any treasurer since Ted Theodore, Hayden had his own views on economics and was keen to engage with treasury officials and then present the resulting position forcefully in Cabinet.

Hayden was pessimistic about Labor being re-elected, but he believed he could limit its time in opposition to one or two terms.

His August 1975 budget was constructed at a time when inflation was almost 18%, which he described as Australia’s “most menacing enemy”

Fighting inflation, carefully

“We are no longer operating in that simple Keynesian world in which some reduction in unemployment could, apparently, always be purchased at the cost of some more inflation”, Hayden declared, breaking with decades of orthodoxy.

Today, it is inflation itself which is the central policy problem – more inflation simply leads to more unemployment.

His first and only budget slashed the rate of growth in government spending, called for restraint in wages growth, cut the rate of company tax and simplified the personal income tax scale.

But Hayden also made it clear he wasn’t going to tighten government spending in ways that would hurt people, saying he rejected

a policy of deliberately creating massive unemployment and widespread business failures in order to stop inflation abruptly.

Coalition staffers later said they had been concerned that Hayden’s appointment as treasurer would “make it possible for Labor to get control of economic policy”.

It might have accelerated their decision to take measures that led to the dismissal of the Whitlam government in November 1975.

After refusing to pass Hayden’s budget between August and November 1975, the Coalition adopted its measures unaltered on taking office.

Labor’s first economic rationalist

In subsequent years, parliamentary journalists Michelle Grattan, Robert Haupt and Greg Hywood described Hayden as perhaps the father of economic rationalism in the Australian Labor Party.

By that they meant recognising that competitive markets and a stable and growing economy could deliver outcomes as useful to Labor as government intervention.

In one of his last acts as Labor leader before being toppled by Bob Hawke in February 1983 Hayden appointed Paul Keating as shadow treasurer.

“The policy coherence that has given Australia its quarter century of uninterrupted growth, began its long coalescence the day Bill Hayden convened his first shadow cabinet meeting,” Keating said of Hayden’s time as Labor leader four decades later.

On Sunday, in remarks in remarks echoed by the current treasurer Jim Chalmers, Keating again paid tribute to Hayden’s contribution.

He said the economic personnel Hayden put in place were “the building blocks the Hawke Government relied upon to shift the country’s policy to the economic rationalism which has since made Australia so flexible and so wealthy”.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock