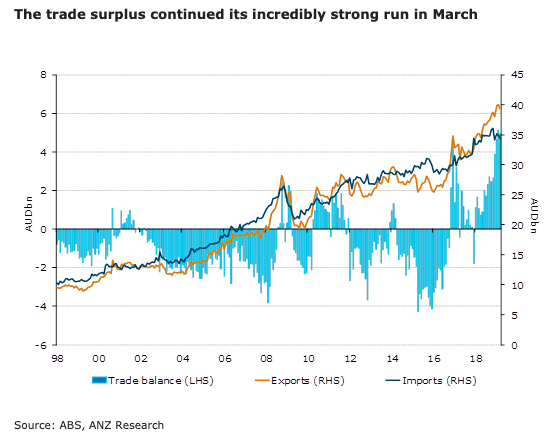

Australia’s monthly trade balance fell slightly to a surplus of AUD4,949 million in March. Underlying this was 1.8 percent fall in exports, while imports were down relatively less for the month. Nevertheless, this was the second highest surplus on record after the revised February surplus.

Resource exports fell 4.3 percent in the month, driven by a 12.2 percent decline in metal ores and minerals and non-monetary gold (which fell 31.0 percent) which was offset largely by a 15.8 percent increase in coal, coke and briquettes.

Rural goods rose 3.2 percent, led by increases in both meat and wool. Manufacturing exports were up 6.6 percent due to a 23.5 percent rebound in transport equipment. Service exports fell slightly, down 0.2 percent as travel decreased 0.3 percent.

Imports intermediate and other merchandise goods increased 1.9 percent m/m, largely due to a 11.7 percent increase in fuel imports. Much of this was likely due to higher prices. Imports of capital goods declined 5.3 percent m/m, led by transport equipment falling 26.4 percent and machinery and equipment dropping 9.7 percent.

Meanwhile, consumption goods imports fell 3.3 percent, driven by a 15.4 percent fall in car imports. Service imports also fell, decreasing 1.1 percent, primarily reflecting a 2.8 percent fall in travel.

"Taken together, the monthly trade data suggests a further positive contribution from net exports towards Q1 GDP and a possibly a close to flat current account for the quarter," ANZ Research commented in its latest report.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility