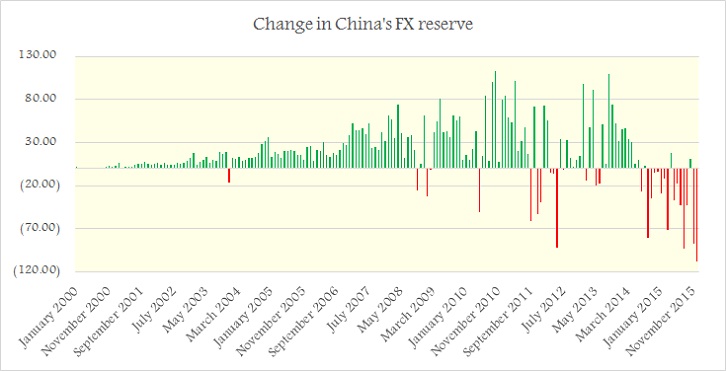

China suffered biggest monthly drop in foreign exchange reserve in December, leading to largest annual drop ever. In December, China's FX reserve dropped by -$107.9 billion, bringing total annual shrinkage to $512.66 billion for 2015, all time record.

Looking at New Year's price action in Chinese assets, in which stock market has dropped more than 7% in two of the four days so far, it seems outflow is likely to continue in January at similar pace. Chinese FX reserve dropped in the back of high current account balance, probably above $60 billion and positive FDI inflows, meaning capital account outflow is quite significant.

Previous monthly record was for August, 2015, when FX reserve dropped by $93.9 billion, at a time when People's Bank of China (PBoC) devalued Yuan by -1.9% in a single day, which ultimately led to massive market turmoil. In November FX reserve dropped by $87 billion.

While large portion of the devaluation in November came in the back of weaker global currencies against Dollar, similar can't be said for December.

China's outflow likely to intensify further in 2016, especially in H1, 2016.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks