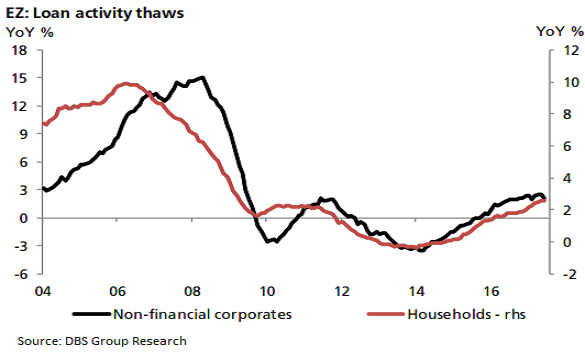

The European Central Bank’s accommodative policy stance continues to thaw credit growth. In Jun17, credit growth to households rose to 2.6 percent y/y, stable from month before but higher than last year’s average 1.7 percent. There are some concerns over a modest slowdown in lending to corporates to 2.1 percent from May’s 2.5 percent, but this is still an improvement from last year.

Broader improvement in other confidence and real data suggests this pullback might be a blip rather than a trend. The ECB’s bank lending survey for Q2 had also signaled that credit standards for loans to enterprises eased slightly, whilst those towards households was largely unchanged. Better access to banks’ and markets-based funding is likely to support the improving consumption and investment trends, entrenching recovery expectations.

Amidst these encouraging signs, the policymakers will be keen to see the extent to which the revival in investment growth improves pricing power and wage pressures. This is necessary to ensure a virtuous cycle for inflation and inflationary expectations.

With inflation still influenced by supply drivers rather than demand-led, we reckon that the markets will not be able to ignore the ECB’s guidance that it will remain patient during the QE withdrawal process. The ECB holds an estimated EUR1.6 trillion worth government debt, which is expected to be unwound, gradually, 2018 onwards.

An ECB official Ewald Nowotny, cited the US Fed’s example, saying that the ECB need not set a time table for unwinding QE purchases. In the immediate term, attention will be on July inflation numbers due on Monday.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility