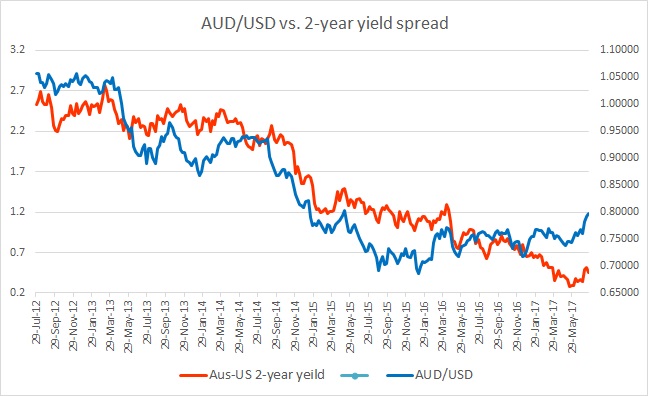

The chart above shows, how the relationship between AUD/USD and 2-year yield divergence has unfolded since 2012.

- It can be seen even with a naked eye, that the pair and the yield spread between 2-year treasury and 2-year Australian government bond have enjoyed a very close relationship.

- While the Reserve Bank of Australia (RBA) reduced rates after the financial crisis of 2008/09, it soon started increasing interest rates due to higher commodity prices and higher inflows from other western economies. However, as commodity prices started declining in 2011, RBA started reducing rates since the end of 2011.

- RBA reduced cash rates from 4.75 percent in 2011 to 2 percent by the summer of 2015. And the yield spread between the two countries declined from 2.53 percent 1.2 percent. During the same period, the Australian dollar declined from 1.056 against the USD to 0.728 against the dollar.

- The exchange rate bottomed in August around 0.69

- However, there has been divergence since then. Between now and the summer of 2015, the RBA reduced rates further by 50 basis points, while Fed raised rates by 100 basis points. The yield spread also declined from 120 basis points to just 46 basis points. However, the AUD/USD didn’t make further low, instead, it has moved higher from 0.728 in July 2015 to 0.8 as of today.

- We believe, that expectations of a rebound in commodities as well as Chinese economy are playing parts here. However, sooner or letter the due would have to converge, which we expect would come in terms of rate hikes from RBA and increase in the spread in favor of the Australian dollar.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure