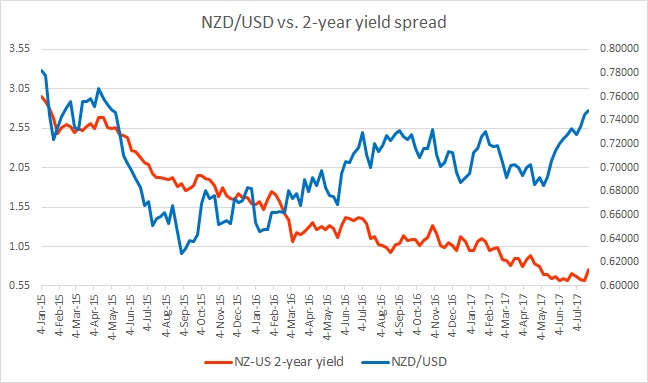

The chart above shows, how the relationship between NZD/USD and 2-year yield divergence has unfolded since 2015.

- The close relations between the short-term yield spread and the exchange rate is quite visible also the big divergence with it.

- While the Reserve Bank of New Zealand (RBNZ) reduced rates after the financial crisis of 2008/09, it somewhat increased interest rates due to higher commodity prices and higher inflows from other western economies. It raised rates by 50 basis points to 3 percent in 2010, only to reduce it again to 2.5 percent in early 2011. In 2014, it increased rates by 1 percent to 3.5 percent and started reducing rates again beginning June 2015. The rates steadily declined from 3.5 percent to 1.75 percent by November 2016, when it signaled a halt.

- It can be seen from the chart that New Zealand dollar declined from 0.78 against the dollar in January 2015 to 0.62 by August, while the yield spread declined from 296 basis points to 192 basis points.

- However, there has been divergence since then. Between now and the August 2015, the RBNZ reduced rates further by 100 basis points, while Fed raised rates by 100 basis points. The yield spread also declined from 190 basis points to just 76 basis points. However, the NZD/USD didn’t make further low, instead, it has moved higher from 0.628 in August 2015 to 0.75 as of today. The divergence is very high, as of now.

- We believe, that expectations of a rebound in commodities as well as New Zealand economy are playing parts here. However, sooner or letter the du0 would have to converge, which we expect would come in terms of rate hikes from RBNZ and increase in the spread in favor of the New Zealand dollar.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal