Bearish AUDUSD scenarios below 0.72 given: 1) the unemployment rate moves back towards 5.75%, raising the spectre of RBA rate cuts; 2) the Fed responds to firm labour market outcomes and above-trend growth by delivering a faster pace of hikes than currently expected; 3) If US-China trade tensions remain the market focus in coming weeks, then the further bearish risks are to 0.72/0.73 mark. China to implement retaliatory tariffs on USD60bn of US imports, conditional on the US proceeding with recently announced measures or 4) risk markets retrace and vol rises as trade war fears escalate.

Weighing on AUD factor have been a pullback in major commodity prices, metals, in particular, investor apprehensions over US-China trade turmoil and the Fed's ongoing optimism on the US economy.

OTC outlook and Options Strategy:

We have advocated delta longs for long-term on hedging grounds, more number of longs comprising of ITM instruments and theta shorts in short-term to optimize the strategy (as shown below).

The execution of hedging strategy: Short 1m (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spike mildly), simultaneously, go long in 2 lots of vega long in 3m (2%) ITM -0.79 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

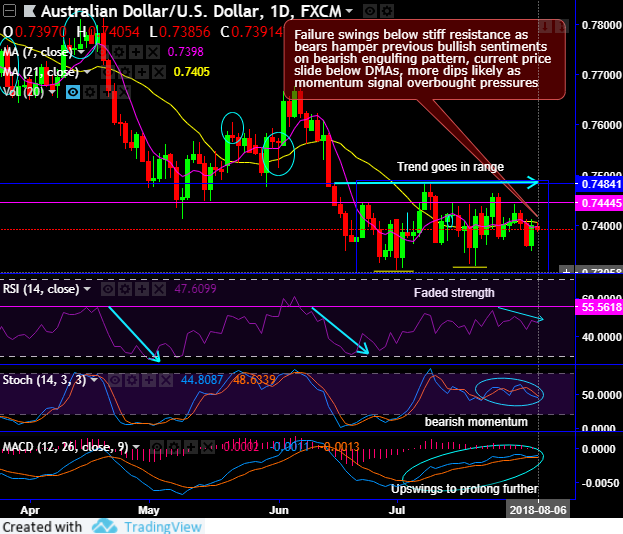

Since the trend of this pair has been drifting in range as you can see the rectangular area on the daily plotting of above technical charts and such price behaviour has been prolonged from last 4-6 weeks, theta shorts in OTM put option has gone worthless and the premiums received from this leg is sure profit.

Most importantly, please be noted that the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 0.7150 levels (above nutshell). While bearish delta risk reversal also substantiates that the hedging activities for the downside risks remain intact ahead of this week’s RBA’s monetary policy.

Accordingly, we would like to uphold the same option strategy as stated above on hedging grounds.

Thereby, deep in the money call with a very strong delta will move in tandem with the underlying.

Both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price dips and bid 2m risks reversals to optimally utilize delta long put options with a view of arresting bearish risks.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 72 levels (which is bullish), while hourly USD spot index was at 25 (mildly bullish) while articulating (at 08:14 GMT). For more details on the index, please refer below weblink:

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks