The Aussie continues to gain background support from solid Chinese bulk prices and the general correction in USD, though a short-term peak appears to be in place at 0.7570. Should risk aversion build, the 0.7430-50 should provide support.

China’s overheated property market showed further signs of cooling in December. We estimate that overall prices moderated to a 19-month low of 0.2% MoM from 0.6% in November. Notably, it is sharply lower from the peak of 2.6% in September.

This is on the back of curbing measures imposed by at least 21 cities since October, including higher down payments on purchases and stricter controls on household permits. For the coming year, we expect the property market to remain soft as the full impact from these measures kick in.

Furthermore, additional measures should not be exactly ruled out given the government’s greater emphasis on restricting speculative purchases. The property market has been a key driver for China’s growth. With the impending slowdown, we expect 2017 GDP to moderate to 6.5% from an estimated 6.7% for 2016.

AUDUSD medium term perspectives: Below 0.7200. The US dollar has had an impressive rise since the US election and has potential to rise further during the months ahead. The Fed’s assertive tightening projections plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar. Against that coal and iron ore are likely to sustain a good portion of their dramatic rises, and economic data should improve in Q4 and Q1, but these forces are subservient to the US dollar’s trend. There’s also the issue of Australia’s AAA rating, seen at risk.

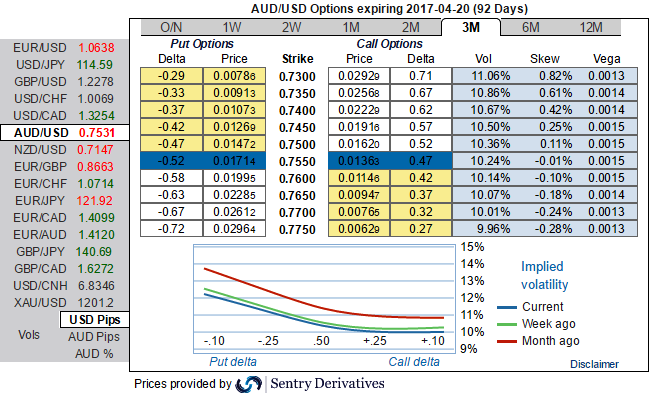

OTC updates:

Please be noted that even though the risks reversals have not shown any significant shift in hedging sentiments, the IV skews in far month contracts of this APAC pair has been evidencing downside risks still remain intact as OTM puts are the bids on high demand, IVs flashing above 10.5% for 3m expiry for 3m tenors.

While delta risk reversal reveals have been neutral to slightly bearish bias, divulging more interests in hedging activities for downside risks. As a result, we can understand ATM puts have been costlier where the spot FX market direction of this pair is heading towards 0.7518 technical levels where we see stiff resistances. So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings and bid on 3m risks reversals.

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary