As the Bank of Japan is lined up for monetary policy announcement tomorrow, which is one of the world’s most dovish central banks, the market consensus in this upcoming event is very meager. Governor Kuroda who has managed a $4T quantitative easing program and negative interest rates over his five-year duration seems an unlikely candidate to bring in hawkish monetary perspectives. This could be majorly owing to the domestic inflation adamantly remains below the BoJ’s 2% target rate. CPI in the Q3 registered at 0.6%, while October CPI came in at just 0.2%.

While CADJPY is perceived to be edgy as the commitment of the BOJ looms to target a 2% inflation rate and anchor bond yields. We see only a small chance of that commitment waning in 2018 because the inflation rate won’t get anywhere near 2%, but the net result is a huge skew in the range of outcomes for the CADJPY.

From last three-four weeks, the prices of this underlying pair have been oscillating between 89.806 and 87.457 levels with more potential on the downside.

Technically, current week prices slid below 21EMA levels (i.e. 88.0688 levels) and head towards wedge baseline, thereby, one could expect more slumps as both the leading oscillators have been constantly converging downwards to signal weakness (refer weekly chart).

Hedging Strategy: Option strips (CADJPY)

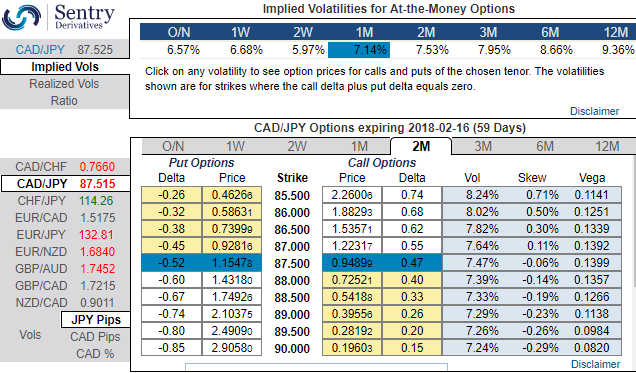

Please be noted that the positively skewed ATM IVs of 2m tenors indicate the hedging interests of OTM put strikes upto 85.50 levels.

To factor-in above stated driving forces, we reckon that the underlying pair has equal chances of moving on either side but with more potential on downside, accordingly, it is wise to initiate longs in 2 lots of 2m ATM -0.49 delta puts, simultaneously, add long in 1 lot of +0.51 delta call of the same expiry, the payoff function of the strategy is likely to derive positive cashflows regardless of swings but more potential from the underlying spot FX moves towards downside.

The risk is limited to the extent of premium paid to buy the options.

The reward is unlimited until the expiry of the option.

Please note that the trader can still make money even if he was wrong, that means the strategy likely to derive handsome yields in premiums regardless of swings. But the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

Currency Strength Index: FxWirePro's hourly CAD spot index is displaying -131 levels (bearish), while hourly JPY spot index was inching higher towards 37 (bullish) while articulating (at 07:26 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

As you could see bullish interest in JPY and at the same time CAD index indicates bearish sentiments, as a result, the bears of this pair are most likely to extend slumps upon our above stated technical rationale.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary