The Sterling and Yen would be in the market focus for this week ahead of BoE and BoJ, not because of Brexit developments but because of the Bank of England’s quarterly inflation report and the Bank of Japan is likely to dispel policy normalisation expectations. While the base case and the consensus are that the BoE is most likely to deliver a 25 bps rate hike which is currently 90% priced in by interest rate markets.

The key issues for markets instead would be the signalling on the future rate hikes. In this context, the number of dissents would be important as will be the newly released BoE’s estimate of the equilibrium real policy rate.

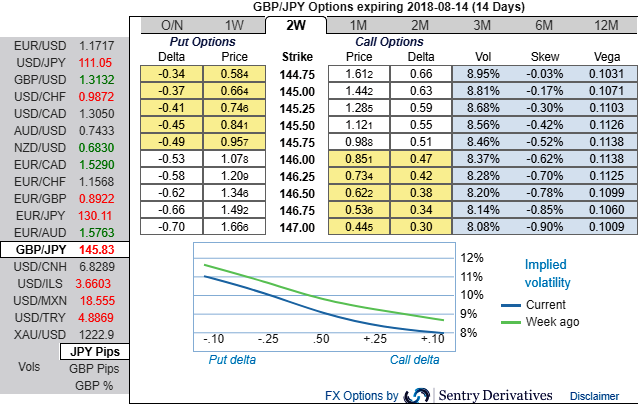

Before we proceed further, please be noted that the positively skewed IVs of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 142 levels, whereas 2w skews are well balanced either side (refer above nutshells evidencing IV skews). As you could observe GBPJPY forward rates across different tenors (refer above nutshell), these derivatives instruments indicate bearish targets of this pair.

The valuation of financial derivative securities crucially depends on the market participants’ expectation of future volatility which is also known as implied volatility, and FX options are no exceptions. Hence, the essence of implied volatility arises as it often garners as much attention as the option price in option listings, and estimation of future volatility is a critical aspect of market research.

Because the option pricing depends on future volatility, and it is quite impossible for anyone to ascertain accurate future volatility.

Nevertheless, it is quite possible to calculate the marketplace’s expected future volatility using the option’s price itself which is known as implied volatility (IV).

Most importantly, GBPJPY bulls all set to get into their business in the near-term. But never forget the major trend of this pair that has tumbled from the highs of 195.833 levels. Despite the pair is undergoing in the consolidation phase, the prices have still remained below 7 & 21-EMAs with strong downside momentum contemplating completely unsettled Brexit dust.

In this bearish scenario, put ratio back spreads have already been advocated a couple of days ago (to be precise on 27th June), we would like to uphold the same strategy with a view to mitigating FX risks both in short and long-run.

Both the speculators and hedgers who are interested in bearish risks in medium-run but dubious about momentary spikes are advised bidding 2m/2w skews to optimally utilize the swings in the underlying spot.

The execution: Uphold longs in 2 lots of vega long in 2m ATM -0.49 delta put options, simultaneously, write 2w (1%) ITM put option. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

The fresh Vega longs are encouraged for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short-term would optimize the strategy. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -78 levels (which is bearish), while hourly JPY spot index was at -188 (bearish) while articulating (at 06:10 GMT). For more details on the index, please refer below weblink:

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target