The yellow metal price would usually be sensitive to moves in both UST rates and USD. The gold prices would be more expensive for holders of foreign currency on the robustness of dollar, while a rise in U.S. rates lifts the opportunity cost of holding non-yielding assets such as bullion.

The predominant driving forces of the gold price in long-term is confidence in the official money and in the institutions (governments, central banks, and private banks) that create/promote/sponsor the official money. While tomorrow’s FOMC decision should help determine the near-term trajectory.

Fed will hike more in order to keep inflation low: With inflation rising, the FOMC will be more confident in rising rates further towards, and finally above the neutral level, estimated at 2¾%. Our forecasts call for four hikes this year and the same number of hikes in 2019. We do not believe that the FOMC will signal so many hikes at this week’s meeting already

The US dollar continued to recover yesterday. The softness in currency is being supported above all by the monetary policy outlook, i.e. the hope of a more rapid normalization of US interest rates on the part of the Fed due to a quick rise in inflation.

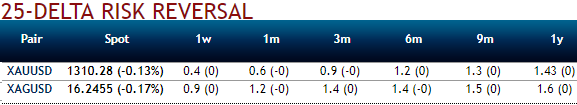

Good ownership in front end Gold skews: With Gold front vols bound to remain firm for longer and as the late cycle Gold rally takes hold on the back of the late Fed, Gold skews should stay supported even as 3M skews are at the highest level since Aug 2017. Positively skewed IVs of 2m tenor have been well balanced that signify the hedging sentiments on either side.

We recommend buying delta-hedged 3M XAUUSD 25-delta risk reversals @ 1.3/1.6 vol.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says