The Australian labour data gave the currency quite a bruising. Employment recorded a surprise fall in October, with the unemployment rate rising. Consequently, the market brought its rate cut expectations forward and is now pricing in a rate step in February with a likelihood of more than 50%, thus three months earlier than before. The Australian central bank (RBA) had sounded more optimistic recently and had signalled a rate pause, but it left the door open for further rate cuts, in particular in case the situation on the labour market were to deteriorate. However, one weak month is unlikely to cause the central bank to panic; instead it is likely to wait for a few further data publications before taking action. All is not lost in AUD yet.

Sterling still edgy on geopolitical surface: Everyone is waiting for Boris Johnson to officially present his plans to avoid a hard border in Ireland to the EU, sentiment amongst British companies is increasingly deteriorating. The PMI for the manufacturing sector have surprisingly printed upbeat numbers in September, actual 48.3 versus consensus 47.0 and previous 47.4 level. Admittedly, all those who are still hoping for an amicable agreement between the UK and the EU are not going to pay much heed to today’s data, as they are going to hope that the economy is going to pick up as soon as the Brexit uncertainty has been overcome. It is uncertain though to what extent the economy will pick up since the spring has been due to global weakness and to what extent it is the result of the uncertainty surrounding Brexit. The economic uncertainty thus remains far higher than many assume.

Recently, dovish voices from the ranks of the Bank of England have also been heard in this connection, speaking of the need for an interest rate cut even in the case of an orderly Brexit. This results in additional risks for Sterling quite apart from Brexit.

GBPAUD has been edging higher amid short-term corrections in the major uptrend as you could observe in the monthly plotting (2nd chart).

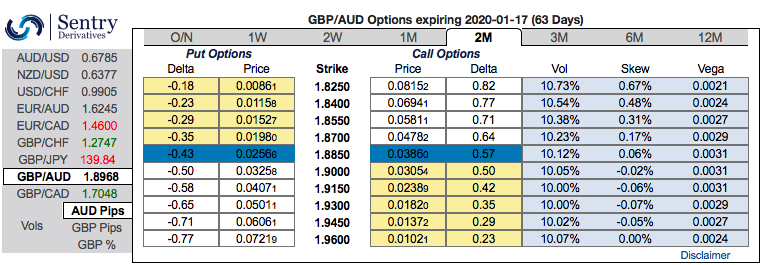

We adcvocate 3-Way Diagonal Options Spread as 1st hedging option.

Ratio: (Long 1: Long 1: Short 1) at spot reference: 1.8969 levels.

The execution: Initiate long in GBPAUD 3m at the money delta call, long 1M at the money delta put and simultaneously, Short theta in 1w (1.5%) out of the money put with positive theta or closer to zero.

Rationale: Contemplating IV skews, short-term and long-term trends that are well balanced on either side, we could expect both minor price dips in short-term and major uptrend remains intact.

The positively skewed 2m IVs are stretched towards both OTM calls and OTM puts (1st chart), we reckon that the Delta instruments are conducive to monitor directional risk so as to be aware that how much of option’s value would increase or diminish as the underlying market moves as this option tool measures the value of an option as the underlying spot FX moves. Well, a higher (absolute) Delta value is desirable on long leg in the above stated strategy. Whereas, the Theta is positive on short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry).

Hence, we advocate the above options strategy with cost-effectiveness that could hedge regardless of the swings on either side.

Alternatively, hedging no.2, we advocated initiating shorts in GBPAUD futures contracts of October’19 delivery and simultaneously, longs in futures of December’19 delivery.

Thereby, the foreign traders, who are dubious about puzzling swings, can directionally position in their FX exposures. Shorts leg has expired now, we wish to uphold the long leg of December deliveries. Courtesy: Commerzbank & Sentry

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September

Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data