The ECB’s Draghi highlighted increased downside risks on a host of uncertainties and near term growth is expected to be weaker than previously expected.

The euro made a new low for 2019 at 1.1304 on bets that the European Central Bank would, at its governing council on Thursday, deliver a downbeat economic outlook. With the ECB downplaying recession risks, this has pushed out rate hike expectations into 2020.

The European Central Bank held its benchmark refinancing rate at 0 percent on January 24thand reiterated it expects key interest rates to remain at record low levels at least through the summer of 2019. The central bank brought to an end its €2.6 trillion bond purchase scheme last month but said it will keep reinvesting cash from maturing bonds for an extended period of time.

OTC Updates and Options Strategies:

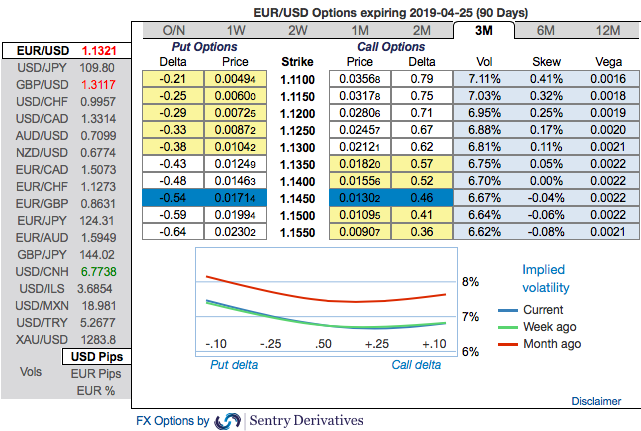

EURUSD 3m positively skewed IVs have been signaling downside risks

Skews stretched towards OTM put strikes signifies hedgers interest in the further bearish risks.

To substantiate these indications, we observe the fresh bids to mounting negative RRs in the 1m coupled, while bearish neutral RRs in the longer tenors remains intact which is in line with the above-stated bearish scenarios.

All these indications coupled with the fundamental news and the underlying scenarios are attractively appealing put holders. Contemplating all these factors, we advocate below options strategy.

The strategy: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 3M tenors. Dubious bulls can also deploy 1% in the money puts with attractive delta. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.

Alternatively, shorting futures of mid-month tenors are also advocated with a view of arresting further potential slumps. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: Sentrix, Saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -92 levels (which is bearish), while hourly USD spot index was at -6 (neutral) while articulating (at 08:17 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch