Since the beginning of last year, US long rates have again become the main USDJPY driver. The BoJ’s peg on JGB yields is going to kill yen rates volatility so that the rates factor should become even more US-centric.

But the mild Treasuries sell-off right after that, which saw 10y yields briefly trading below 1.40%, was not enough to lift the US dollar. At the same time, the FX market challenged the BoJ, so that USD/JPY and the US yields diverged. Lagging US yields – a catch-up would imply a move above 105.

This correlation is notably unstable, but the mean-reversion between FX and rates has been powerful over recent years. US rates are now unlikely to drift much lower and should not precipitate a USDJPY break, meaning a catch-up higher is a more likely scenario. The current relationship suggests a move above 105.

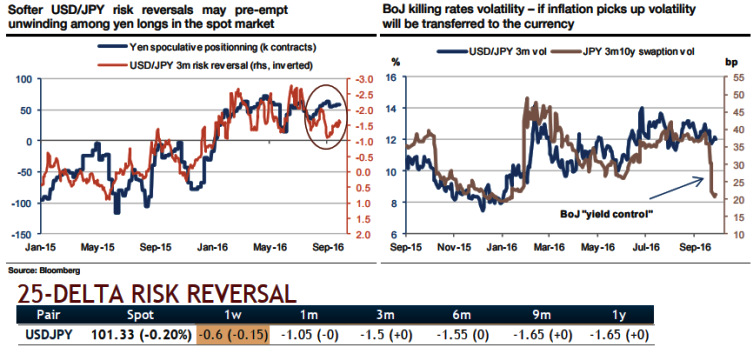

Softer options positioning may pre-empt an unwinding of yen longs:

Positioning in spot and options markets tends to evolve in tandem, even if options investors are expressing views with a conditional nature.

Since the CFTC records futures positions, the current long yen positioning has only been matched by the 2008 peak reached when Bear Stearns collapsed.

Such an extreme positioning is hardly sustainable, and the softer skew in yen options markets might be sending the signal that longs are eroding (the 3m risk reversal is decoupling from futures positions – see above nutshell and graph).

On top of that, OPEC’s surprise announcement of production cuts is supporting risky assets, instating a risk-friendly environment (higher stocks and commodities), which should further discourage yen longs.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic