In H2, we expect AU growth to remain subpar and AUD to drift lower. There are a few key things to watch in 2016. Governor Stevens retires in Sept 2016 while a federal election must be held tomorrow; opinion polls are fairly evenly balanced, although betting markets suggest a Liberal-National Coalition win.

The shock Brexit result is likely to be an important part of the policy deliberations when the RBA Board meets on next Thursday, while AU’s current account deficit is also worth tracking.

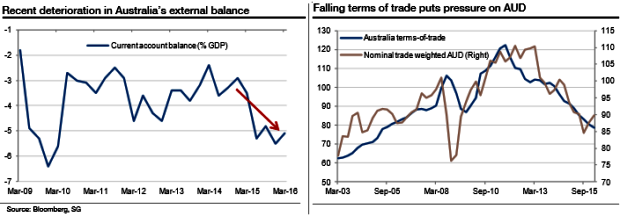

The fundamental backdrop for the Australian dollar remains challenging, though the trade-weighted AUD has fallen significantly from its highs in early 2012. The Australian economy is gradually transitioning away from the natural resource sector, aided by low-interest rates and a weaker currency.

But the current account imbalance has widened in recent quarters, non-mining CapEx growth has been elusive, the RBA is firmly on a dovish policy setting, the above chart shows that FX market implied volatility is elevated, Fed policy normalisation remains on track and risks to the Chinese growth outlook abound.

The Australian terms of trade are still falling, and thus the fundamental path of least resistance for AUD is for further depreciation. This, plus the persistent and surprising disinflationary pressures in Australia, has kept the RBA on an easing bias, with one rate cut expected in H2 16. Monetary divergence should thus be another factor in the second half of the year for a lower AUD/USD as the Fed readies to tighten again.

The persistent weakness in nominal GDP growth has had negative consequences for government revenues, and fiscal policy should remain constrained. The opposition Labour Party has committed itself to fiscal consolidation to preserve Australia’s AAA credit rating. There is thus unlikely to be significant changes to fiscal policy whatever the outcome of the July 2016 general elections.

Moreover, global macro uncertainty has buoyed global FX implied volatility. This has historically been a negative factor for AUD and we expect it to remain so. While we do see further weakness in AUD through H2 16, it should be at a more gradual pace given the sizeable valuation mean-reversion that has already occurred. But we do see value emerging in the AUD/NZD cross at current levels.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data