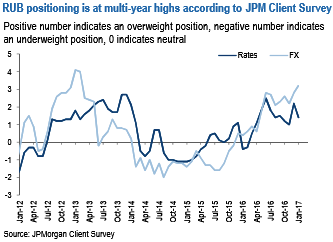

Every good structural story needs a repricing and a clear-out of extended positioning. The medium-term case for Russian local markets is underpinned by high nominal and real interest rates, falling inflation, and a trend of improving macro policy credibility. Yet investors are already positioned to be very long and valuations are only beginning to correct from a starting point of overvaluation (refer above graphs).

In this context, the decision of the CBR to intervene in the FX markets to the tune of $2bn per month is a catalyst for positioning to wash out and a repricing of Russian local rates and currency assets in the short term.

The FX intervention program will be a meaningful drag on the BoP. To put this into perspective, the currently estimated $23bn FX intervention in 2017 compares to our $33bn current account surplus forecast for the year.

The 2015 FX reserve accumulation program resulted in at least 5% RUB depreciation. This is based on the RUB depreciation over the period adjusted for movements in oil and CDS prices.

RUB is overvalued. In our short term FX model, RUB entered the FX intervention announcement trading 2% rich to oil. This has now been corrected to a flat position but we still expect the currency to have to start trading cheap to oil. In our long term REER model, RUB is 5% rich.

RUB positioning is extended. RUB is now the second most extended long globally after BRL.

Oil positioning is extended. Net longs in crude are at their highest levels since mid-2014 increasing risks for a correction. While the new intervention policy should eventually limit RUB’s sensitivity to oil, this will only be the case once RUB reaches its new equilibrium. From current levels, we believe oil price correction is a complementary risk.

To express this view of short-term risks pointing to a repricing and clearing out of long positions, we recommend the following trade: Go long USDRUB with a 63.5 target and 58.5 review level.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady