BoJ likely will ease next week, using all existing tools, while the government may release the outline of its fiscal package.

The major currencies have slumped to the multi-month lows against yen and it is also deemed as Asian safe haven in Yen, signalling the bets on speculation over an intrusion by BoJ to arrest the further appreciation of Yen.

July flash PMI and large firms business sentiment showed resilience after Brexit but continued fall in new export orders is worrisome

All-industry activity index suggests that growth momentum is picking up a bit after stagnating since 2Q15. The fiscal package appears to be larger than expected, but fiscal thrust could be much smaller.

The benefits of a weaker CAD are expected to present a boost to growth via exports and there are signs that the most exchange rate sensitive sectors are already performing well. Crude prices managed to slide below $45, we stress that the lack of a recovery in crude oil prices remains the most important risk to our CAD outlook.

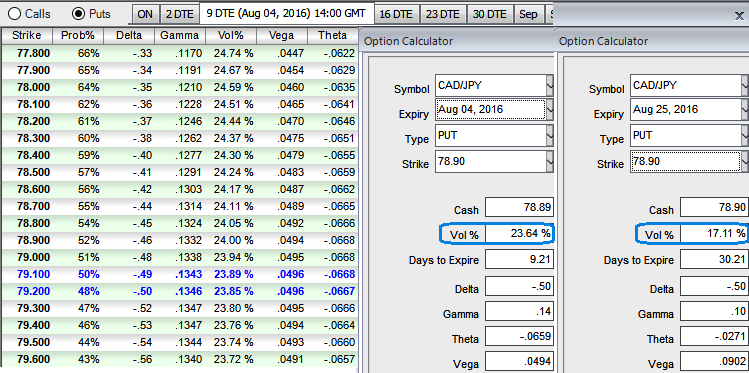

Please be noted that the yen currency crosses have shown a spectacular IV shifts above 20% in 1w expiries and CADJPY has been no exceptions to flash spiking IVs at 23.64% in 1-week expiries amid all these developments, we see healthy vega along with these rising IVs on OTM put strikes. This shows the significance of bearish interest in this pair.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.