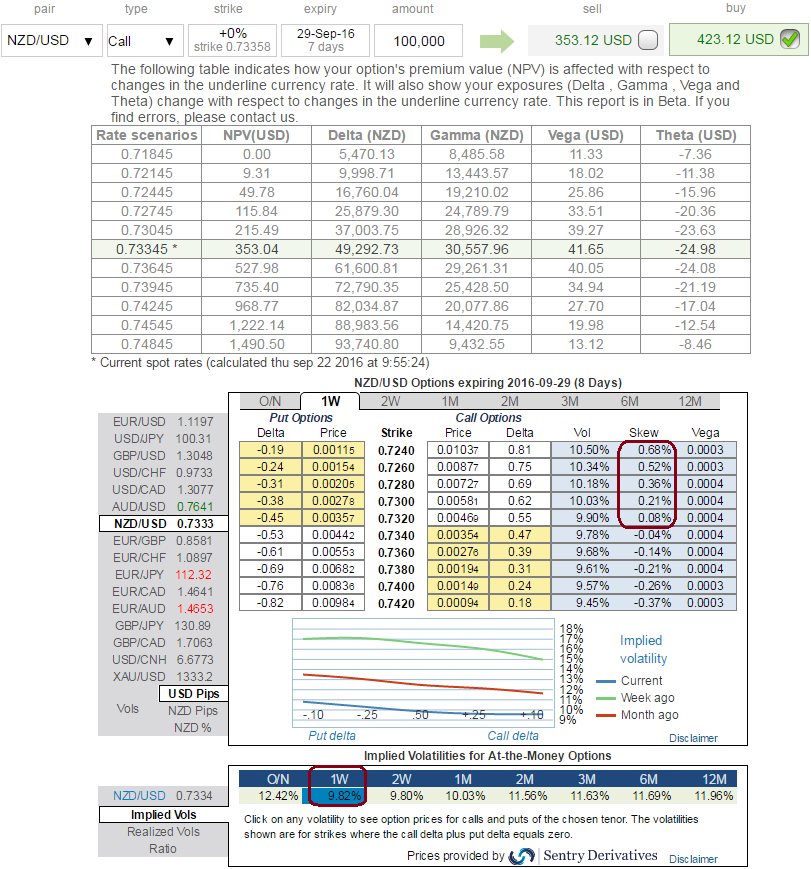

You can observe ATM implied volatilities of NZDUSD of 1w expiries have massively collapsed from 14.53% to the current 9.82% (just within two days) as this morning the RBNZ stays pat in its monetary policy, leaving the OCR unchanged at 2.00%, which is in-line with the market expectations.

While 1w ATM call premiums are priced at 19.83% more than net present value, hence, it is deemed as the disparity between the pricing and IVs that signify as to where could be the direction of the underlying spot, the volatility of an asset (currency pair, stock, or commodity) price is simply how much it fluctuates with no regard to direction.

Moreover, you can also make out the significance of IV skewness highlights the hedgers' interests in downside risks as they flash positive numbers towards OTM put strikes.

Implied volatility refers to the volatility of the underlying price over some period in the future. The price of an option depends on future volatility.

Much of the language from the August Monetary Policy Statement was retained in today's release, most likely deliberately so.

The statement acknowledged the economic developments since August, without altering its bottom-line assessment on inflation. Dairy prices have risen strongly, although there is still a great deal of uncertainty around the full season outcome; the NZ dollar has risen more than expected; strong GDP growth was broadly in line with expectations; and there are early signs that the latest round of lending restrictions is having a dampening effect on the housing market.

The RBNZ again noted that annual inflation is expected to rise from the end of this year, as some temporary factors drop out. Nevertheless, the RBNZ still faces an uncomfortably slow return to the inflation target, with the risk that persistently low inflation leads to a further decline in wage and price expectations.

NZDUSD fell about 28 pts to 0.7332, while the two-year swap rate fell 4bp to 2.04%. After the central bank’s Market pricing for a November OCR cut has risen to around a 70% chance.

Contemplating the above IV indications and fundamental aspects, we could foresee the underlying spot FX (NZDUSD) would drag towards OTM put strikes as per the IV nutshell as shown in the above diagram. As a result, in such scenario, OTM call writing would be a smart trading idea.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential