The OCR is biased lower, but like the consensus and market, we don’t expect action at the OCR Review on Thursday. Further easing will be signalled – the NZD is too deflationary to ignore, and doing nothing would send it further skyward – but the RBNZ has shown a preference to move on Monetary Policy Statement dates.

We remain in an environment where conventional policy signals (growth, output gap, housing, capacity) are flagging no change (or hike!), but they are going head-to-head with factors that are by-and-large beyond the RBNZ’s control (global scene, NZD) amidst some concerns over consistently low inflation influencing price-setting behaviour.

The environment needs pragmatism, balance, and measured messages. We expect further policy easing to be signalled, leaving the door well and truly open to a November cut. The strong NZD will continue to “make it difficult for the Bank to meet its inflation objective”. That highlights the direction of risk for the OCR. We suspect that the 35bps of additional OCR cuts signalled in the August MPS are still more-or-less the RBNZ’s base case. And that is broadly consistent with current market pricing.

FX Option Outlook:

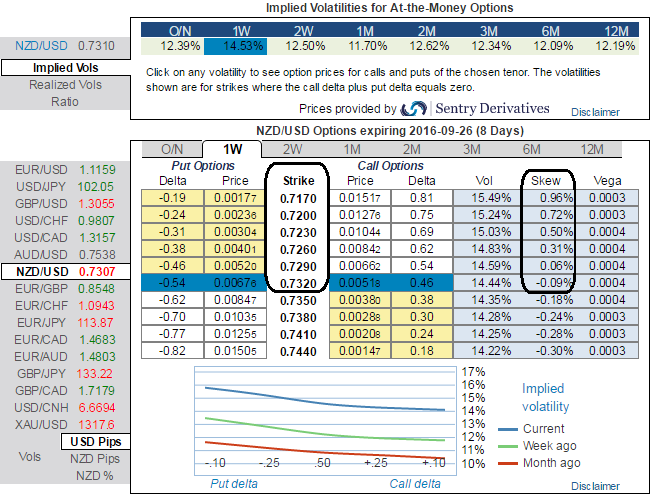

Although the NZ dollar edged higher against its U.S. counterpart during early Asian trading sessions and 1w implied volatilities are flashing shy above 14.5% ahead of above mentioned RBNZ’s monetary policy season, IV skewness signifies the OTC interest in OTM put strikes.

Hence, if you want to write calls, OTM call options instead of ATM calls are deemed the right choice in prevailing bearish environment.

Expensive implied volatility and spot within a channel Implied volatility is elevated compared to realized volatility, suggesting a structure selling it.

The downside skew is not sufficiently elevated to finance a put via low strikes (a put spread-like structure), but the negative skew is enough to obtain an attractive discount via a downside knock-out.

Such a barrier is appropriate for trading moderate NZDUSD downside, keeping in mind that the spot has been trapped within a bullish channel since the start of the year and that 0.70 is below the support line.

Hence, we think call writing could also be beneficial as IV skewness is conducive for prevailing bearish environment.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different