After the ECB yesterday highlighted growing downside risks to the EU economy, today’s manufacturing and services PMIs will provide further evidence on whether underlying growth momentum continues to soften. Last month, the manufacturing and services PMIs fell to 51.8 and 53.4, respectively. Both these outturns were the weakest for more than two years. For December we look for further, albeit small, declines to 51.6 and 53.3, while the consensus forecasts are for no change.

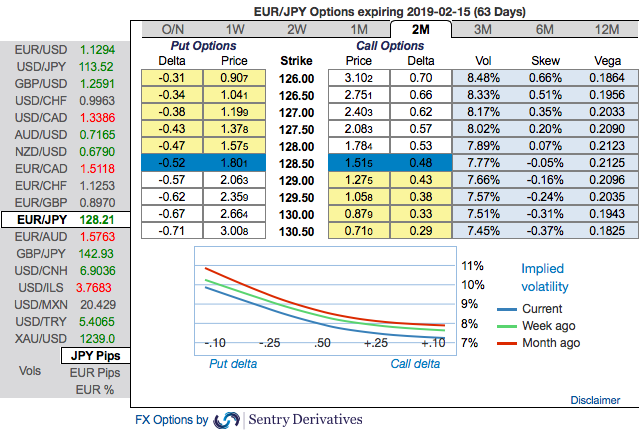

Hedging skewness: Please be noted that the positively skewed IVs of 2m tenors are signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 126 levels so that OTM instruments would expire in-the-money.

Risk reversals: Most importantly, to substantiate the above indications, negative risk reversal numbers of all euro crosses except EURGBP (especially EURJPY) across all tenors are also substantiating bearish risks in the long run amid minor abrupt upswings in the short-term. IVs for 2w tenors are on lower side which is interpreted as conducive for put option writers, and 2m IVs are on higher side which is good for the put holders.

Overall OTC barometer is noteworthy size in the forex options market that can stimulate on the underlying forex spot rate.

Options Trade Tips (EURJPY): Buy 2m EURJPY (1%) ITM -0.69 delta puts for aggressive bears on hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money put option with a very strong delta will move in tandem with the underlying. Source: sentrix, saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -79 levels (which is bearish), while hourly JPY spot index was at 24 (mildly bullish) while articulating at (10:36 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One