We have been recommending shorts in GBP since early April as a core part of our overall defensive strategy. The bearish view has been motivated by multiple fundamental factors—ongoing Brexit ramifications, an already-large current account deficit and now a substantially larger fiscal deficit as well. Focus is now increasingly going to be on the possible extension of the transition period which under the terms of the Withdrawal Treaty has to be decided on by the end of June. The COVID-19 outbreak has resulted in obvious delays in the discussions and has had large economic ramifications, which is why our economists now think that a 1-year extension (to the end of 2021) has become increasingly likely (Brexit: the June flashpoint looms). While the EU is open to such an extension, recent news reports suggest that the UK government has pushed back against it.

The economists note that UK’s stance raises the odds that we enter July with no extension in place which would make for a messy outcome and at an extreme, could raise the possibility of a “no-deal”. Immediate attention will be on the May 11th second round of talks between UK-EU negotiations. The BoE next week will get some attention as well as we expect it to increase its QE programme by 50% or £100bn. This would take announced UK QE to a table-topping 13.5% of GDP. As set-out in the Outlook, GBP faces stiff headwinds from the combination of excessive QE, eye-popping fiscal issuance, and a large current account deficit.

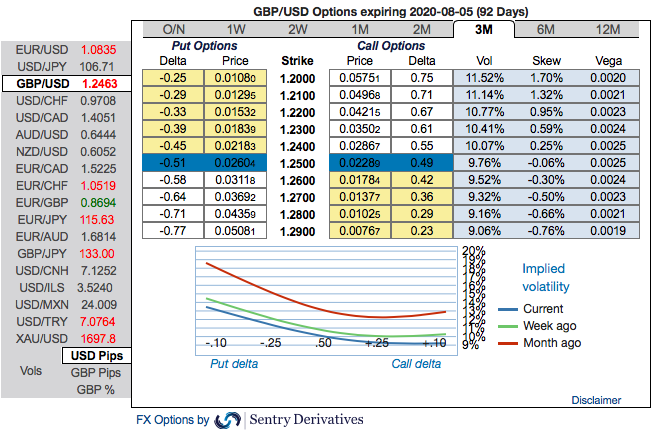

Trade tips: Stay short in GBPUSD 1.227 levels via optionality, at the beginning of April. Marked at -2.06%.

The rationale: GBP will likely take its directional cue from the read-through to BoE’s rate cut whereas the size of the move will be augmented or moderated by the government’s broader policy platform, this is factored-in GBP’s FX options market.

Please observe 3m GBP skews that has stretched towards negative territory, hedgers have shown interests for bearish risks as you could see more bids for OTM Put strikes up to 1.20.

To substantiate the downside risk sentiment, fresh bids in risk reversal numbers have still been signalling bearish hedging sentiments in the long run. Accordingly, we advocate the diagonal options strategy on both hedging and trading grounds.

Though the underlying spot FX is showing some resistance to the prevailing bearish streaks, these rallies seem to be momentary. Hence, this is right time to write deep OTM put options.

Execution of strategy (Debit Put Spread): Capitalizing on the above factors, it is prudent to deploy diagonal options strategy by adding short sterling via a limited loss tail hedge: Stay short a 1M/2W GBPUSD put spread (1.20/1.2850), spot reference: 1.2460 level.

Alternatively, activate shorts in GBPUSD futures contracts of May’20 deliveries with an objective of arresting potential slumps. Courtesy: JPM, Sentry & Saxo

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close