USDJPY forecast is trimmed with no change in the big picture. JPY has gained more than 3% in trade-weighted terms and appreciated against other G10 currencies. The BoJ policy meeting is scheduled on Wednesday, and is the main Japanese event this week, with most focus on the Policy Board’s updated economic forecasts. Some disappointing activity data – especially the lower base provided by the Q3 GDP report – will require a downward adjustment to its forecast for growth, at least for FY18 (currently 1.4%Y/Y). The inertia of underlying inflation, step down in oil prices, and government plans to abolish pre-school education fees, demands a downwards revision to the BoJ’s inflation projections. In our view, the Bank’s forecast for core CPI in FY19 of 1.4%Y/Y (excluding the impact of the consumption) could be as much as 1ppt too high. But the updated Outlook Report will likely see the Board’s median view nudged only modestly lower, with comfort still taken from its estimate of a positive output gap and tight labor market. So, the BoJ will remain constructive about the medium-term inflation outlook, albeit still reluctant to place a date on when the current 2% target might actually be achieved.

Meanwhile, USDJPY started its downward trend in mid-December with growing concerns about global economic slowdown and risk asset sell-offs.

USDJPY started this year at 109-handle, followed by a sharp decline to 104.10 on January 3 this year, and was temporarily back to the pre-flash crash level this week.

The appreciation of JPY since December was not something we had expected. Outside FX markets, risk asset markets started to aggressively price in a global economic slowdown, and we saw more than 15% decline in S&P500 from its high to the bottom in December (though it recovered 10% already). With the market volatility, Fed Chair Powell has shifted to a more dovish stance, emphasizing uncertainties and downside risks to global growth and a cautious assessment of global financial market developments.

FF future markets now even price in the possibility of a rate cut by the Fed this year. Given the dovish shift of the Fed and the developments in the financial markets, our economists now look for two hikes by the Fed this year (originally three hikes were expected).

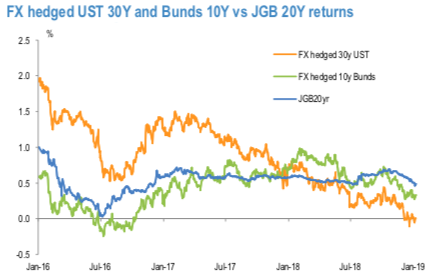

Furthermore, our rates research teams revised down their forecasts of UST and JGB 10Y yields to 3.20% and 0.10% respectively. Courtesy: Bloomberg, JPM

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at -57 levels (which is bearish), hourly USD spot index was at 161 (bullish) while articulating at (09:41 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal