Since the Bank of Japan remains concerned by yen strength and could prevent a move below 100.

Leveraged call spread is welcome as the dollar buoyed at 100 while thanking to high 2m volatility.

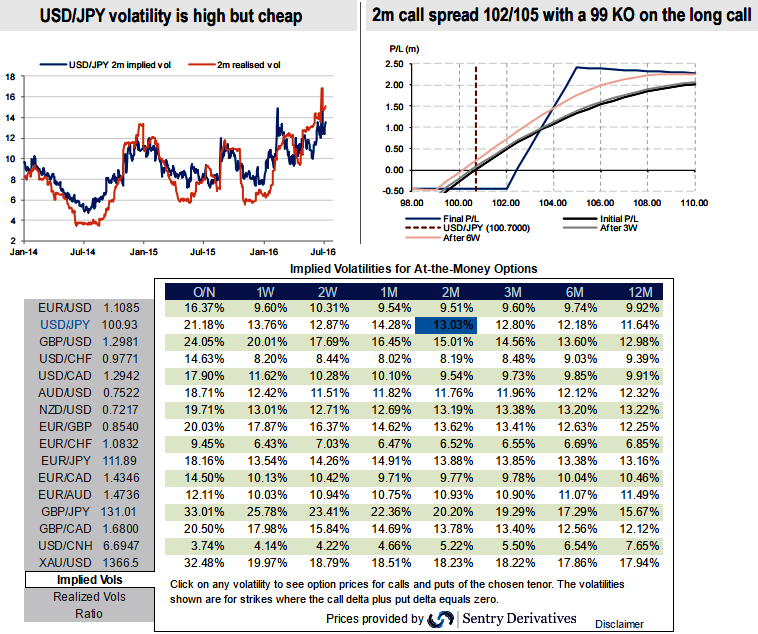

Brexit uncertainty is preventing volatility to collapse. USDJPY 2m vol is, however, cheap, as it trades below the realized vol. The market should, therefore, experience larger spot deviations than what is discounted; making a tight call spread strikes 102/105 naturally highly leveraged.

At spot ref: 101.06, initiate longs in USDJPY 2m call strike 102.50 knock-out 99, short 2m call strike 105.

Risks: USDJPY hitting 99 and bouncing above 105.

If USDJPY hits 99 at any time, investors are left short a naked call strike 105 and are exposed to unlimited topside risks in the event of a sharp bounce from 99.

But the option would be 6 figures OTM, leaving time to either unwind the trade or implement a delta hedge.

USDJPY likely to bounce when risk aversion subsides:

Risk aversion is pressuring the USDJPY to fresh lows. Prices are gradually discounting the possibility of the activation of Article 50 by the UK (The Treaty of Lisbon) and there should be no rush to trigger it. The market is likely to take profit on risk-off positions, providing near-term relief to USDJPY.

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings