The Bank of Japan (BoJ) in its November 1 monetary policy meeting mentioned its optimism over the growth of the economy, with a moderate rate of recovery observed in the global demand. The central bank is expected to maintain an easing bias, but shall not remain compelled to ease in the medium term.

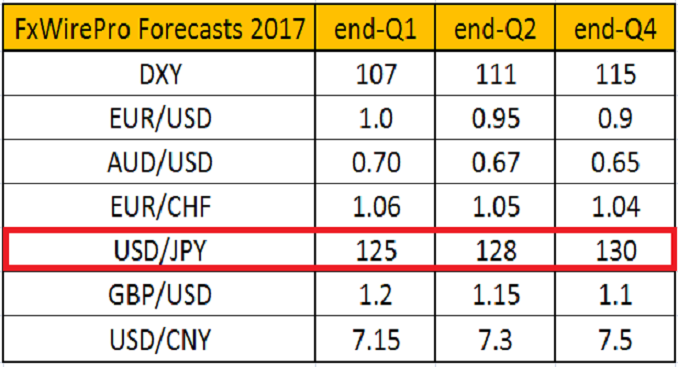

We foresee that the USD/JPY currency pair will test the 130 level towards the end of 2017, for the first time since April 2002. Also, the 10-year Treasury yield spread will likely widen, at over 250 basis points for the first time since 2010.

The BoJ aims at achieving the 2 percent inflation target with expectations of buying around JPY80 trillion of government bonds per year. Upward pressure on global yields since the US election could potentially mean more QE, though.

If Trump successfully implements his fiscal plan, consumer inflation will surely rise, giving the Federal Reserve wider space for an interest rate hike. Thereby, rising Fed fund rate will increase the cost of borrowing. After the Presidential election result, JPY witnessed a massive selling against U.S. dollar, sending the USD/JPY higher by 17 percent to 118.67 in just a month’s time.

Lastly, the BoJ’s first two-day monetary policy meeting for 2017 will take place on January 30-31. We foresee that the central will remain committed to holding its 10-year JGB yields near zero, while keeping interest rate steady at -0.10 percent.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist