USD-EM spot rates should be upwardly biased, and the bulk of total return performance in 2018, if any, should come via carry – similar to the past two years. The risk to our forecasts is a stronger performance in 1H’2018. From a dispersion perspective, the TRY, ZAR, MXN, and BRL could show the highest level of dissimilarly compared with the rest of the EM currency universe.

USDTRY has flatlined since the start of the year as there’re a few investors willing to buy the TRY once the diplomatic scoreboard has been tallied even though the underlying currency (lira) remains vulnerable to a move higher in US real yields. This is as domestically real yields are still too low to sustainably bring down inflation while funding the current account deficit requires positive risk appetite to support portfolio inflows.

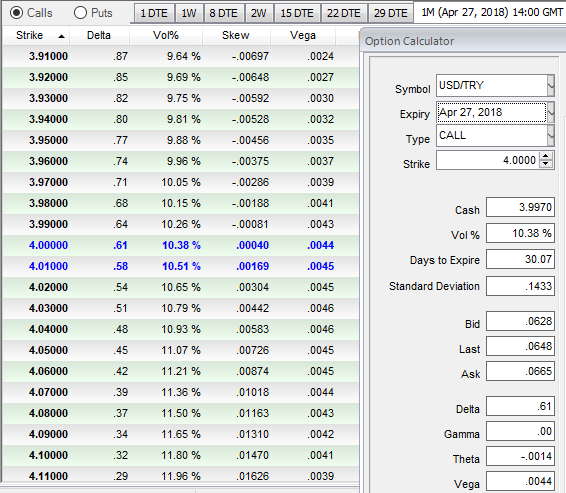

While USDTRY ATM vol is cheap (1m – 10.38%) vs. carry, risk-reversals are even cheaper. One measure of a carry-adjusted risk reversal is carry-neutral delta-hedge ratio –the notional of forward delta hedge that needs to be layered atop unit notional/leg of a risk-reversal in order for the static points carry of the forward at expiry to completely offset the net option premium of the risk-reversal.

The lower this ratio, the cheaper the risk-reversal; in extremis, a ratio of zero indicates that the risk-reversal itself is costless and requires no bleed-reducing forward hedge overlay. The above chart shows that this gauge is historically even more extreme than the corresponding metric for ATMF straddles.

Carry-neutrally delta-hedged risk-reversals are not just skew valuation metrics, but can also function as tradeable constructs for playing defensive directional views. Consider the following as a bearish TRY expression: Off spot ref. 4.9550 and 3M forward ref. 5.0620, buy €100 mln/leg of a EURTRY 3M 5.22 / 4.82 risk-reversal @ 76bp/92bp net premium indic. (vols 12.4/13.1 indic. vs. 10.6 choices) and sell €25mn of EURTRY 3M forward.

The notionals of the option and forward legs are sized such that the static carry on the forward with unchanged spot completely offsets the net riskie premium. The net package has a BS forward delta of €24mn (€49mn of the risk-reversal -€25mn of the forward), which is, in theory, “carry-free. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings