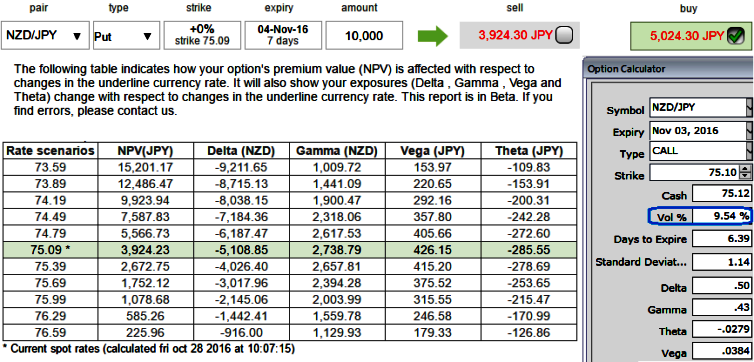

For an instance, 1w ATM puts and calls of this pair are trading 28% and 30% respectively more than NPV.

While the ATM implied volatilities of the same tenor are at just shy above 9.5%. The standard deviation of this put options 1.14. Hence, we see there exist disparity between IVs and option pricing.

An option writer wants IV to shrink so that the premiums also fall correspondingly. Please be noted that the narrow-dated options are less sensitive to IVs, while long-dated are more sensitive.

While if you have to think economic event risks, very little NZ releases over the next 48 hours.

Technically, the short-term trend of NZDJPY has been bullish, but observing the struggling attempts of breaching stiff resistance at 74.871 marks. This is also a considerable conducive environment for OTM option writers as the underlying spot is likely to drift in sideways as you could probably observe the current prices go in sideway trend from the last couple of months (see monthly price pattern).

However, the genuine threat for this pair is that RBNZ is expected to cut the OCR further to 1.75% in next monetary policy meeting - a record low (scheduled on 10 November). That has been well signaled by the RBNZ, which has acknowledged the strong economy but cites very low inflation which, at 0.2% YoY, is well below its 2.0% target midpoint.

Markets have partly priced in this scenario of one more cut and then a lengthy period on hold, which also matches our option market sentiments, if you have to observe the impact of all these factors in currency prices, please observe the consolidation pattern in the current prices on monthly terms.

During the month ahead any probe above 75.687 is possible, this is driven by good quality NZ economic data, and on the contrary, a BOJ’s shift in monetary policy stance, and US treasury yield-chasing inflows.

By year end, there’s a case for a correction towards 76.848 levels as the RBNZ eases OCR below 1.75% in November as per the expectations.

Contemplating all these factors lingering around spot NZDJPY rates, we foresee opportunity lies within shorting an OTM puts in any hedging or speculating strategy would determine to be the best selection of option instrument.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says