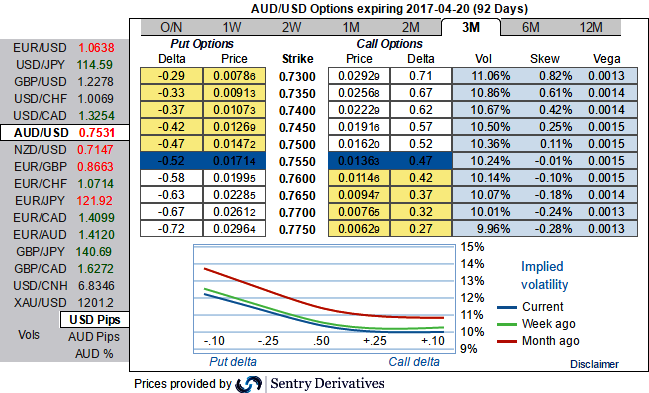

AUDUSD's higher IV with negative delta risk reversal can be interpreted as an opportunity for put longs as the market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Fed Chair Yellen delivered hawkish comments on Wednesday, adding that the economy is approaching the Fed's dual mandate of inflation and employment. She further mentioned that the US is near full employment and with inflation figures stabilizing, there is a need for gradual Fed tightening, although she did not mention the exact timing of an interest rate hike.

Hence, as shown in the diagram, contemplating the above risk reversal computations, we construct strategy comprising of both calls as well as puts in the ratio of 2:1 so as to suit the swings on either direction.

In the major downtrend of this pair, capitalizing on reducing IVs we eye on shorting out of the money calls with shorter expiries which would lock in certain yields by initial receipts of premiums and risk reversals to favor longs in puts in lengthier tenors.

Well, here goes the strategy, go short in 1m (1%) OTM calls and simultaneously, 2 lots of 3m puts (+1% ITM, and ATM strikes) are preferred to suit the prevailing losing streaks. So thereby the combination would be executed for net debit and the cost is reduced by short side.

Moreover, the strategy could be counterproductive as the positively skewed 3m IVs to favor OTM puts strikes (please refer IV nutshell).

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings