Finance ministers from the Group of Seven (G7) nations met in Banff, Canada, aiming to ease tensions over U.S. President Donald Trump’s tariffs and preserve global economic cooperation. Despite broader disputes, the G7 focused on shared concerns including Ukraine support, China’s non-market practices, and financial crime.

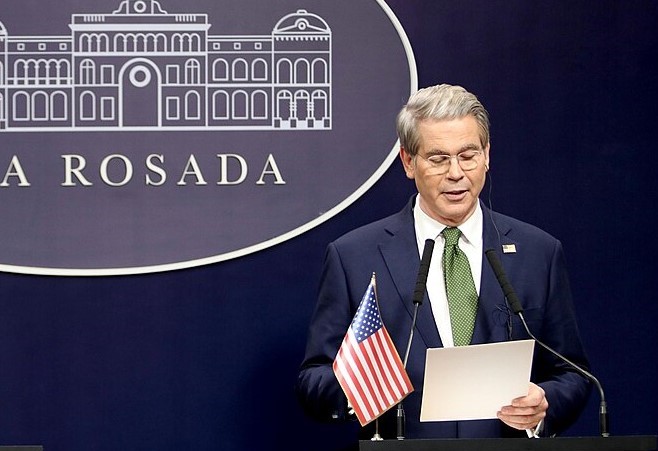

U.S. Treasury Secretary Scott Bessent characterized the meetings as productive, highlighting improved diplomatic tone compared to 2018, when Trump’s tariffs fractured talks. This year, tariffs are more expansive, but G7 ministers attempted to find compromise with Bessent, who was described by European officials as “flexible” and willing to engage.

However, divisions remain. The U.S. opposed language calling Russia’s invasion of Ukraine “illegal,” while Italy pushed to block companies aiding Russia from postwar reconstruction contracts. G7 delegates also debated lowering the $60 price cap on Russian oil, with the EU advocating tighter sanctions.

Bessent’s stance emphasizes U.S. priorities: stricter measures against China’s trade subsidies and reluctance to endorse any communique not aligned with Washington’s goals. Meanwhile, Japan and the U.S. agreed their current dollar-yen exchange rate reflects economic fundamentals, though no specific currency targets were discussed.

Trump’s global trade stance continues to weigh on allies. Japan, Germany, France, and Italy may face U.S. tariffs exceeding 20% by July. Britain still bears 10% duties on most goods, and Canada contends with separate 25% tariffs.

Despite uncertainty over a final joint statement, participants stressed the importance of constructive dialogue. Germany’s Finance Minister Lars Klingbeil and Bessent agreed to continue talks in Washington, signaling efforts to stabilize G7 relations amid mounting global economic pressures.

By balancing cooperation with national interests, the G7 seeks to maintain relevance in shaping global trade and financial policy.

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  NATO to Discuss Strengthening Greenland Security Amid Arctic Tensions

NATO to Discuss Strengthening Greenland Security Amid Arctic Tensions  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound

Asian Markets Slip as AI Spending Fears Shake Tech, Wall Street Futures Rebound  UAE Plans Temporary Housing Complex for Displaced Palestinians in Southern Gaza

UAE Plans Temporary Housing Complex for Displaced Palestinians in Southern Gaza  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off