The GBP is expected to strengthen against the greenback despite slow-moving Brexit negotiations amid a rate hike delay by the Bank of England (BoE). The pound weakened notably in August and a key factor in that was the continued caution of the MPC. Expectations of a possible rate hike later this year had been rising but expectations fell back as the MPC indicated its view on the outlook for the UK economy had deteriorated.

The BoE cut its real GDP forecasts by 0.2 and 0.1 point to 1.7 percent and 1.6 percent for this year and next year respectively. The MPC maintained its view that it would likely need to raise rates more than what is currently priced into the market given the rise in inflation to above target, but this message was lost given the more pessimistic outlook on the economy had reduced the risks of a rate hike over the remainder of the year.

The probability of a rate hike in November fell from 35 percent at the end of July to 21 percent at the end of August. We have pushed back the timing of the first rate increase from November to February next year. While the BoE downgraded its growth outlook, the flow of economic data continues to point to a positive performance of the economy given the ongoing uncertainty related to Brexit. Business sentiment surveys indicate a very bright outlook for export sales while retail sales and employment data in August were stronger than expected.

Credit flow data also points to a potential pick-up in investment activity. Lending to non-financial corporations jumped to GBP 8.1bn in July, the strongest monthly increase since the series began in 2011. Much of the flow of credit (GBP 5.6bn) was to the manufacturing sector pointing to the positive export outlook fuelling loans to finance investment to expand businesses. The pound also suffered in August to increased signs of gridlock in Brexit negotiations. Tensions have certainly escalated with Michel Barnier calling for the UK to get serious while Brexit Secretary Davis called on the EU to be more flexible. This gridlock could continue to weigh on pound sentiment. These concerns resulted in little attention being given to the Labour Party shift in Brexit policy. The key opposition party is now formally supporting continued Single Market access during a long transition phase. This means only a small number of Conservatives would be required to reach a majority in parliament for this transition state.

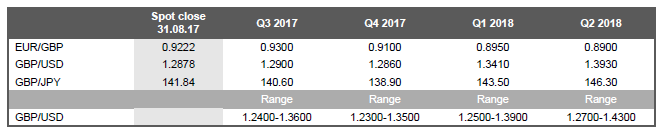

The BoE rate hike push-back and the slow progress in Brexit negotiations has led us to lower our bullish GBP forecasts. But we still expect renewed appreciation ahead.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran