Pharmacy benefit manager shares dropped sharply Wednesday as lawmakers introduced bipartisan legislation requiring health insurers and PBMs to divest pharmacy operations within three years. The proposal intensifies scrutiny of the PBM industry's influence over drug pricing.

Bipartisan Bill Targets Vertical Integration in Healthcare

According to Reuters, following the presentation of a bipartisan measure on Wednesday, which would compel health insurers or drug intermediaries to sell off their pharmacy businesses, shares of companies owning pharmacy benefit managers declined.

The majority of pharmacy benefit management (PBM) in the US is controlled by CVS Health’s Caremark, Cigna’s Express Scripts, and UnitedHealth Group’s Optum. All three of these parent firms also own health insurance businesses.

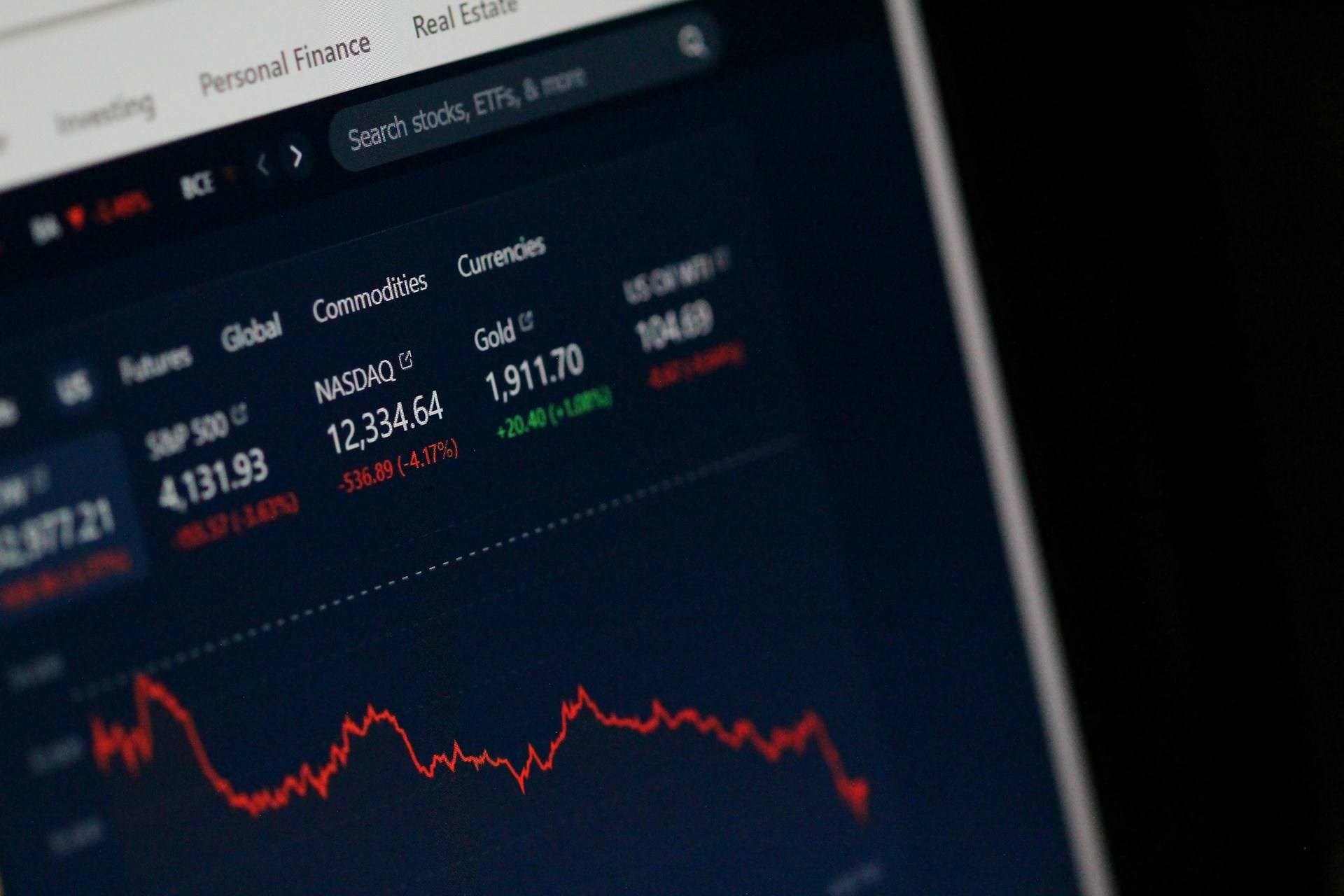

Following the initial reporting of the bill in the Wall Street Journal, all three firms' shares fell by 4.8% to 5.5%.

The bill, which is being co-sponsored by Republican Josh Hawley and Democratic Elizabeth Warren in the United States Senate, would require, within three years, that companies that own health insurers or pharmacy benefit managers sell their shares in pharmacies.

Healthcare Stocks React to Bipartisan Proposal

This bill will be submitted in Congress with the support of Republican Diana Harshbarger and Democratic Jake Auchincloss.

Pharmacy benefit managers (PBMs) mediate pricing negotiations for prescription prescriptions between insurance companies, pharmacies, and pharmaceutical companies. PBMs then pay pharmacies directly for the medications covered by their contracts.

They have already been investigated for the impact they have on the cost of prescription drugs.

"PBMs have manipulated the market to enrich themselves — hiking up drug costs, cheating employers, and driving small pharmacies out of business. My new bipartisan bill will untangle these conflicts of interest by reining in these middlemen," Senator Warren stated.

Other Insurers Feel the Ripple Effect of PBM Legislation

Other insurance companies' stock prices dropped 1% to 3%. This included Centene, Elevance, and Humana, Investing.com shares.

"The latest introduction of potential legislation to restrict PBM operations and broader healthcare vertical integration is unlikely to gain traction, although it is hard to dismiss outright," Michael Cherny, an analyst at Leerink Partners, said.

Insurance company stock has taken a beating following last week's shooting death of UnitedHealth health insurance unit CEO Brian Thompson outside a Manhattan hotel.

Anthropic Refuses Pentagon Request to Remove AI Safeguards Amid Defense Contract Dispute

Anthropic Refuses Pentagon Request to Remove AI Safeguards Amid Defense Contract Dispute  Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock

Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock  Malta will gain from smart heritage

Malta will gain from smart heritage  Boeing Secures $166.8 Million U.S. Navy Contract for P-8A Engineering and Software Support

Boeing Secures $166.8 Million U.S. Navy Contract for P-8A Engineering and Software Support  Australia Housing Market Hits Record High Despite RBA Rate Hike

Australia Housing Market Hits Record High Despite RBA Rate Hike  OpenAI Pentagon AI Contract Adds Safeguards Amid Anthropic Dispute

OpenAI Pentagon AI Contract Adds Safeguards Amid Anthropic Dispute  Global Markets React as Dollar Surges, Swiss Franc Rallies After U.S.-Israel Strike on Iran

Global Markets React as Dollar Surges, Swiss Franc Rallies After U.S.-Israel Strike on Iran  Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement

Venezuela Oil Exports to Reach $2 Billion Under U.S.-Led Supply Agreement  Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts

Panama Investigates CK Hutchison’s Port Unit After Court Voids Canal Contracts  FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications

FCC Approves Charter Communications’ $34.5 Billion Acquisition of Cox Communications  Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade

Trump Warns Iran as Gulf Conflict Disrupts Oil Markets and Global Trade  The strikes on Iran show why quitting oil is more important than ever

The strikes on Iran show why quitting oil is more important than ever  Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology

Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology  Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom

Samsung Electronics Stock Poised for $1 Trillion Valuation Amid AI and Memory Boom  Gold Prices Surge Over 2% After U.S.-Israel Strikes on Iran Spark Safe-Haven Demand

Gold Prices Surge Over 2% After U.S.-Israel Strikes on Iran Spark Safe-Haven Demand  Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models

Meta Signs Multi-Billion Dollar AI Chip Deal With Google to Power Next-Gen AI Models  China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump

China’s New Home Prices Post Sharpest Drop Since 2022 Amid Ongoing Property Slump