Revising the generous fuel tax credits given to businesses should be a priority for the Albanese government, because keeping them would conflict with two other pressing priorities: reducing carbon emissions and repairing the budget.

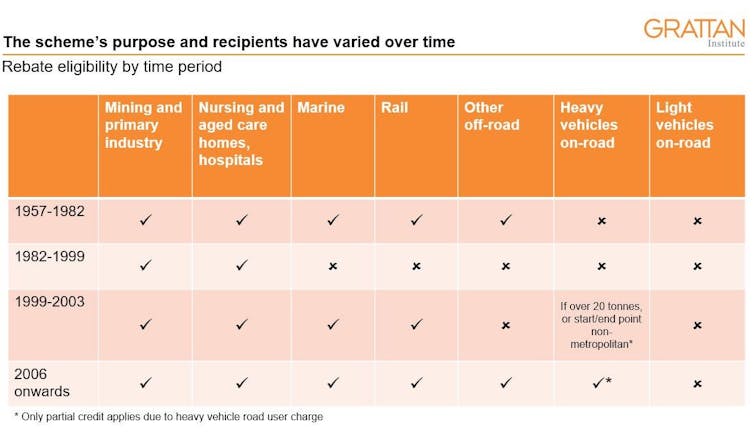

Fuel tax exemptions have existed for as long as the federal government has taxed fuel, starting in 1957. With the rationale for the tax being to pay for building and maintaining roads, initially all off-road users were exempt.

But the earmarking of all fuel tax revenue for spending on roads ended in 1959 – more than 60 years ago. With the tax becoming a general revenue-raiser, the rationale for exemptions or tax credits has shifted with the disposition of the government of the day.

The settings inherited by the Albanese government now cost the budget almost $8 billion a year.

As long ago as 1991, the Australian National Audit Office recommended the credit scheme “clarify its purpose and objectives”. Yet those objectives remain unclear today.

Who benefits most?

Previous governments have argued exemptions and tax credits support regional industries, and people living in regional areas.

In 1999, when the credit was extended to marine, rail, and some trucks and buses, the then-deputy prime minister (and National Party leader) John Anderson said the goal was to reduce transport costs, particularly for “those people living in regional, rural and remote areas”.

In 2006, when expanding the credit to include all off-road users and on-road vehicles weighing over 4.5 tonnes, the then-assistant treasurer Peter Dutton said: “This is good news for business, and regional Australia in particular.”

But if the aim of the policy is to support regional areas, fuel tax credits are a poorly targeted way to do so.

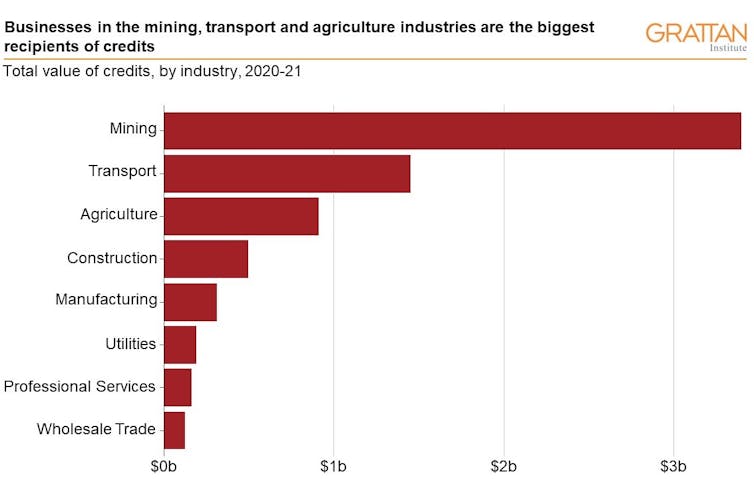

In the five industries that receive almost 90% of the value of credits, more than 60% of businesses, and 67% of employees, are in major cities.

There is no evidence fuel tax credits particularly benefit regional areas, or that they are more effective than other policies in doing so.

It is hard to avoid the conclusion that fuel tax credits are mostly a gift to the mining and agricultural industries – the only non-care industries that have always received an exemption from paying taxes on fuel, and the major recipients of fuel tax credits today.

Budgetary needs have prompted changes

Changes to fuel tax credits have also aligned with the budgetary needs of the government of the day.

In 1982, when government debt as a share of GDP was rising steadily, the Fraser government narrowed the scheme to just mining, primary industries and care industries. Many businesses previously exempt – including in rail, marine, construction and manufacturing – were forced to pay fuel taxes.

In 2006, the Howard government broadened the scheme during the mining boom when budget surpluses meant no net debt for the first time in 30 years.

Despite the straightened fiscal position the government now faces, the credit scheme remains unchanged.

Out of step with net zero and budget repair

The Albanese government has several growing spending obligations, particularly in health, aged care, disability care and interest expenses on its debt.

After stripping out the effects of temporary factors such as high commodity prices, there remains a stubborn gap between government receipts and spending of about $40 billion a year.

In a new report published by Grattan Institute, Fuelling budget repair: How to reform fuel taxes for business, we argue fuel tax credits should be removed for on-road users, and roughly halved for off-road users. This would save about $4 billion a year.

It would also reflect the environmental and health costs of diesel use.

Giving businesses tax credits on for consuming fuel without having to pay for or reduce their carbon emissions is sharply at odds with the government’s goal of net zero emissions by 2050. Diesel combustion currently accounts for 17% of Australia’s emissions.

In 2020, the top five industry recipients of fuel tax credits directly produced more than half of Australia’s emissions. That share is expected to reach 64% by 2030.

As well as helping repair the budget, reducing fuel tax credits would signal to businesses that they need to consider emissions in their investment decisions, minimising the costs to future consumers, taxpayers and shareholders.

Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment

Asian Markets Slide as Nvidia Earnings, U.S.-Iran Tensions and AI Valuations Weigh on Investor Sentiment  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute

Ecuador Raises Tariffs on Colombian Imports to 50% Amid Border Security Dispute  Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom

Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom  Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand

Gold Prices Rally in February as Geopolitical Risks and Economic Uncertainty Boost Safe-Haven Demand  Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors

Dominican Republic Unveils Massive Rare Earth Deposits to Boost High-Tech and Energy Sectors  Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty

Trump Touts Stock Market Gains and 401(k) Boost Amid Tariff Uncertainty  USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports

USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports  U.S.-Canada Trade Talks Resume as Trump Administration Reviews USMCA

U.S.-Canada Trade Talks Resume as Trump Administration Reviews USMCA  Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit

Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit  Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA

Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA  Japan Nominates Reflationist Economists to BOJ Board, Signaling Policy Shift

Japan Nominates Reflationist Economists to BOJ Board, Signaling Policy Shift  Gold Prices Rebound as U.S. Tariffs, Fed Policy and Iran Talks Drive Market Sentiment

Gold Prices Rebound as U.S. Tariffs, Fed Policy and Iran Talks Drive Market Sentiment  Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran

Strait of Hormuz Oil and LNG Shipments Disrupted After U.S.-Israel Strikes on Iran  IMF Urges U.S. to Cut Fiscal Deficit to Reduce Trade and Current Account Gaps

IMF Urges U.S. to Cut Fiscal Deficit to Reduce Trade and Current Account Gaps