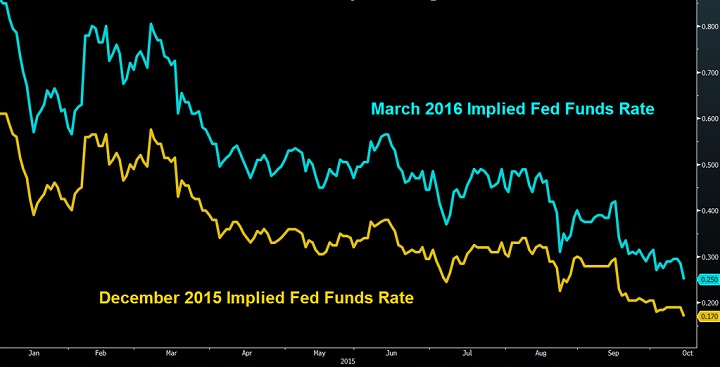

Rate hike expectations is taking serious beating after retail sales disappointed last night and in fact surprised to the downside.

Traders now expect, FED is unlikely to hike not only this year but till March next year. As shown in the figure, implied FED fund rate for December has now fallen to 0.17% as of yesterday and for March it has fallen to 0.25%. With serious roll back in expectation Dollar has taken a large hit against almost all currencies. Chart courtesy Bloomberg.

Pound has now on the verge of breaking above 1.55 area, Euro tested 1.15 today. Yen is the top performer today trading at 118.3 against Dollar.

Commodity currencies have fared much better altogether. New Zealand Dollar is now up close to 600 points. Canadian Dollar has broken below key resistance of 1.29 against Dollar (USD/CAD) looking to gain further.

Further weakness in Dollar is very much possible, given year long extreme one sided bets. Focus is on inflation data today, to be released at 12:30 GMT.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate