Indonesian imports growth is expected to ease through this year compared to last year as lagged impact of Rupiah depreciation will start to take effect, in addition to lower oil price, according to the latest research report from DBS Economics.

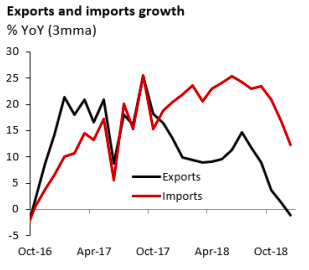

Worsening trade balance is the biggest risk; despite declining oil price, the trade deficit will still likely widen to USD4.6 billion in Q4 2018 from USD2.6 billion in Q3 2018. Imports have eased significantly in December 2018 to 1.2 percent y/y from 11.8 percent y/y in November last year, but not enough to compensate the contraction of exports, recording -1 percent y/y in Q4 2018 from 9.5 percent y/y in the first three quarters.

Yet, the risk of exports slowdown might remain on the horizon despite the more competitive Rupiah as China and overall global trade demand fall. In fact, exports to China has already contracted significantly starting in November 2018, averaging -0.1 percent y/y from 33.5 percent y/y between Jan-Sep.

Even though terms of trade have improved with lower oil price, trade deficit might stay wide as the difference between imports and exports volume growth becomes wider. There are no short-term solutions to close this imports-exports gap. Industrialization plan to develop export-oriented industries would be beneficial in the medium run, the report added.

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains