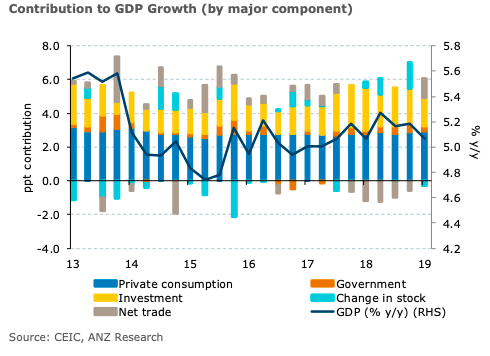

Indonesia’s growth in gross domestic product (GDP) eased during the first quarter of this year, broadly in line with expectations. While government spending growth picked up ahead of the April elections, and private consumption growth edged up, these were offset by a pullback in investment growth and a slump in exports.

The country’s growth slowed from 5.18 percent y/y in Q4 to 5.07 percent y/y in Q1, the softest reading in a year. The breakdown showed a slump in exports (-2.08 percent y/y), though a sharper fall in imports (7.75 percent) meant that net exports were a positive contributor to headline growth.

Government spending growth picked up from 4.56 percent y/y in Q4 to 5.21 percent y/y to Q1 ahead of the April elections, while private consumption growth (including non-profit institutions serving households) edged up slightly.

However, there was a significant pullback in investment growth from 6.01 percent to 5.03 percent, the slowest pace in two years. Meanwhile, inventories were a drag on growth in Q1 after providing a considerable boost the quarter before.

Looking ahead, domestic demand will be a key support to economic activity, but slowing global growth and weak prices for Indonesia’s key commodity exports such as coal and palm oil are impediments to faster growth. Lower export revenues would constrain firms’ profitability, the government’s revenues, and (potentially) workers’ incomes. Accordingly, Indonesia’s GDP growth is likely to remain stuck around the 5 percent-mark, ANZ Research noted its latest report.

"Today’s weak data strengthens the case for BI to lower its policy rate, and our base case is for two 25bps worth of cuts this year. BI has signalled a rising emphasis on supporting growth, as reflected by its announcement of a range of accommodative policies at its last monetary policy meeting in April. That said, the recent volatility in the rupiah suggests an imminent move at BI’s upcoming meeting on May 16 is unlikely," the report further commented.

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains